- No annual fee

- Complimentary Qantas Frequent Flyer membership

- 0.5 Qantas points per $1 spent

- 8.99% for the first 6 months on balance transfers and purchases

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

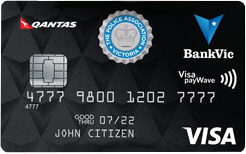

BankVic Credit Cards

BankVic Qantas Visa Credit Card

Updated 19 September 2024

Earn uncapped Qantas Points on your everyday card spending and save $0 annual fee, low balance transfers and purchases interest rate of 8.99% for the first 6 months plus, complimentary Qantas Frequent Flyer membership. Exclusively for TPAV and VAU members. T&Cs apply.

Points Earn Rate (per $1 spent)

0.5 points

QantasRewards Program

Qantas Frequent Flyer

Bonus Points

N/A

Pros and cons

- This card is only available exclusively for TPAV and VAU members

Creditcard.com.au review

Editor Review

BankVic Qantas Visa Credit Card

The BankVic Qantas Visa Credit Card

Available to The Police Association Victoria (TPAV) and Victorian Ambulance Union (VAU) members only, the BankVic Qantas Visa Credit Card is a fantastic option for those who qualify to earn uncapped Qantas Points while paying no annual fee. In terms of extras, the card offers complimentary Qantas Frequent Flyer membership, as well as 8.99% p.a. on purchases and balance transfers for six months.

What we love...

Before we go any further on this review, we should make a point of saying the BankVic Qantas Visa Credit Card is available exclusively to TPAV and VAU members who are also BankVic members. Even if you are the spouse or dependent of a TPAV or VAU member, you cannot apply for this card. However, TPAV and VAU members who apply and are approved may nominate one additional cardholder on the account.

Why is the card exclusively for TPAV and VAU members? Well, for one thing, this card is a seriously good deal. As a cardholder, you will pay no annual fee ever, while earning uncapped Qantas Points on your everyday card spending. What that essentially means is you are earning rewards while paying zip for the privilege. In credit card land, that is living the dream.

In terms of points-earning potential, the card doesn’t have the highest earn rate out there, but it is still pretty good considering its no annual fee status. You will earn:

- 1 Qantas Point for every $2 you spend (uncapped)

- 1 additional Qantas Point for every $1 you spend on Qantas purchases, including Qantas flights, and Qantas Club and Qantas Frequent Flyer membership purchased directly from Qantas.

As we mentioned previously, you can choose to add an additional cardholder to the account at no extra cost. This not only streamlines your family finances, it can also help you earn points even faster as your additional cardholder uses their card day-to-day. On top of that, you will enjoy complimentary Qantas Frequent Flyer membership if you are not yet a member.

As you accrue Qantas Points, they will be automatically credited to your Qantas Frequent Flyer Account once a month, as long as you have provided the bank with your Qantas Frequent Flyer membership number. Then you are free to do with your Points as you wish. You could redeem them for flights or upgrades, pay for Qantas insurance or goodies from Qantas Wine, or pick up something special from the Qantas Store.

Aside from its rewards program, the BankVic Qantas Visa Credit Card also has a very appealing two-part intro offer on the go. As a new cardholder, you can benefit from 8.99% p.a. on both purchases and balance transfers for six months. You can balance transfer up to 95% of your approved limit, and any amount left unpaid at the end of the intro period reverts to the purchase rate.

What’s not so great...

Really, the only fault we could find on the BankVic Qantas Visa Credit Card is the fact that application is exclusively for TPAV and VAU members. It has a reasonable purchase rate for a rewards card, and some nice perks on the side, especially for a no annual fee card. We’re only sore because it’s not available to everyone.

Why should you choose this card?

If you’re a TPAV or VAU member who wants to earn Qantas Points, there’s really not much point looking beyond the BankVic Qantas Visa Credit Card. You’ll be hard pushed to find another Qantas-earning card with perks such as complimentary Qantas Frequent Flyer membership available plus, no annual fee. The only thing we’d say is that, as with any rewards card, the balance should be paid off by the due date each month to avoid interest accruing, to fully enjoy all the value this card offers.

Aside from the extras we’ve already mentioned, the card also provides up to 55 days interest free on purchases as long as you pay off your balance month to month and don’t have a balance transfer on the card.

Overall Rating

A seriously rewarding rewards card, the BankVic Qantas Visa Credit Card offers uncapped Qantas Points earning, complimentary Qantas Frequent Flyer membership, and 8.99% p.a. on purchases and balance transfers for six months – all for no annual fee.

User reviews

Rates and fees

Interest rates

Purchase rate 18.95% p.a.

Introductory purchase rate 8.99% p.a. for 6 months

Cash advance rate 18.95% p.a.

Interest free period on purchases up to 55 days

Balance transfer

Balance transfer rate 8.99% p.a. for 6 months

Balance transfer revert rate 18.95% p.a.

Balance transfer from personal loan No

Balance transfer fee No fee

Balance transfer limit 95% of approved credit limit

Brands you can't balance transfer from BankVic

Credit limits

Minimum credit limit $5,000

Maximum credit limit $30,000

Fees & repayments

Annual fee $0 p.a.

Additional cardholder fee $0 p.a.

Foreign transaction fee 2%

Minimum repayment 2.5% or $20, whichever is greater

Cash advance fee Free

Late payment fee $9

Rewards and points

Rewards program

Rewards Program

![]() Qantas Frequent Flyer

Qantas Frequent Flyer

Bonus points N/A

Annual points cap uncapped

Bonus points spend criteria N/A

Earning points with this card

Qantas Rewards points 0.5 points per $1 spent

Points cap per month N/A

Overseas earn rate same as standard earn rate

Additional features

Complimentary insurance

International Travel Insurance Yes

Flight Inconvenience Insurance No

Transit Accident Insurance No

Smartphone Screen Insurance No

Purchase Protection Insurance No

Extended Warranty Insurance No

Rental Vehicle Excess In Australia Insurance Yes

Extras

Travel insurance underwritten by Allianz Global Assistance

Overview

BankVic Qantas Visa Credit Card

The BankVic Qantas Visa Credit Card is available exclusively for TPAV and VAU members.

Key features

- No annual fee

- 8.99% for the first 6 months on balance transfers and purchases

- 0.5 Qantas points per $1 spent

- Up to 55 days interest-free on purchases

- Complimentary Qantas Frequent Flyer membership

- Tap and pay with Apple Pay and Google Pay

Minimum criteria to apply for this card

-

Be over 18 years old

-

Good Credit and have not applied for multiple credit cards recently

-

Permanent Resident or Australian Citizen

You have your personal details ready to complete the online application

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Arpan Kundu

11 March 2025Pauline

13 March 2025Wilaiwan

22 June 2024Pauline

25 June 2024Andrew

3 June 2023Pauline

6 June 2023Phil

17 November 2022Pauline

18 November 2022Phil

2 November 2022Pauline

3 November 2022Andy

27 June 2022Pauline

28 June 2022Michael Higgins

13 May 2022Pauline

18 May 2022CHarlie

7 March 2022Pauline

7 March 2022melissa green

13 October 2021Roland

14 October 2021