- 13.05% p.a. for purchases and 14.80% p.a. for cash advances

- Receive 0.66% cash back for every eligible dollar back into your bcu transaction or savings account, capped at $500 p.a.

- Up to 52 days interest-free on purchases

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

bcu Credit Cards

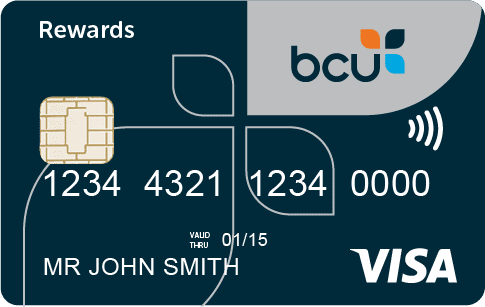

bcu Rewards Credit Card

Updated 14 December 2024

Enjoy low interest rates of 13.05% p.a. on purchases and 14.80% p.a. for cash advances. Earn 0.66% back on every dollar they spend on eligible purchases. Plus, receive up to 52 days interest-free on purchases. T&Cs apply.

Purchase Rate (p.a)

13.05%

Annual Fee (p.a)

$89

Pros and cons

- No balance transfer offer

Creditcard.com.au review

Editor Review

bcu Rewards Credit Card

The bcu Rewards Credit Card

Making it super easy to earn cashback on everyday card spending, the bcu Rewards Credit Card is a great alternative to standard rewards cards. With a low purchase rate and a reasonable annual fee, the card keeps its features fairly simple, concentrating on those cashback rewards, while providing access to credit.

What we love...

There’s no denying earning rewards can be pretty exciting. It feels like you are getting something for nothing, like you are getting a little treat simply for spending on your credit card. But, rewards programs can be complicated. Sometimes it can be hard to work out whether you are actually getting value for money.

Which is where the bcu Rewards Credit Card comes in. Unlike standard rewards cards that earn points that are then redeemed for rewards, this card earns cashback, which can be spent in any way the cardholder pleases. There are no tiered earning structures to remember, and cardholders don’t have to pour over rewards options, trying to figure out how to redeem their points to get the best value from them.

Instead, cardholders simply earn 0.66% back on every dollar they spend on eligible purchases. So, for every $1,000 you spend on the card, you will get $6.60 back. In case you were wondering, eligible purchases are most purchases made on the card, apart from cash advances, BPay, fees, charges and enforcement expenses, interest, balance transfers or transactions for business purposes.

When you apply for this card, bcu will automatically open a Rewards Savings Account in your name. Each month, the cashback you have earned will be automatically credited to this account. You can then spend it as you like. How much value does this offer? You would need to spend $13,500 on your card each year to cover the annual fee, but from there, all points are yours. Take note, the maximum cashback you can earn annually is $500.

In terms of costs, the card has a low rate for a rewards card. But, carrying a balance and paying any interest on it – even if it is at a low rate – will make it very hard to enjoy real value on the cashback rewards you receive. Instead, it’s better to clear your balance by the due date, and then you can enjoy the card’s interest-free feature, with up to 52 days interest-free on purchases.

What’s not so great...

The main sticking point on this card is its application process. While most providers now offer online or over-the-phone credit card applications, bcu requires new cardholders to visit a branch to apply. As long as you live near a branch, this could be easy enough, but with branches focussed along the Queensland and NSW coast, it’s not going to be possible for all applicants.

Why should you choose this card?

If you clear your balance each month and want to earn something back on your credit card spending, the bcu Rewards Credit Card could offer real value. Cardholders who don’t have time for complex rewards programs, or who simply want to earn cashback to spend as they like can enjoy an easy way to get something back on their spending day-to-day.

Unlike some rewards cards, this one offers a low minimum credit limit of $500, making it a good choice for cardholders who want to reduce their temptation to overspend. And of course, as a credit card, it provides all the access and security features you would expect, including worldwide acceptance, contactless payments via Visa payWave, and security via Verified by Visa.

Overall Rating

An everyday rewards card that offers cashback on card spending, the bcu Rewards Credit Card is a basic offering with a low purchase rate and reasonable annual fee.

User reviews

Rates and fees

Interest rates

Purchase rate 13.05% p.a.

Cash advance rate 14.80% p.a.

Interest free period on purchases up to 52 days

Credit limits

Minimum credit limit $500

Maximum credit limit $100,000

Fees & repayments

Annual fee $89 p.a.

Additional cardholder fee N/A

Foreign transaction fee 3%

Minimum repayment 3% or $10, whichever is greater

Cash advance fee $5

Late payment fee $5

Additional features

Complimentary insurance

International Travel Insurance No

Flight Inconvenience Insurance No

Transit Accident Insurance No

Smartphone Screen Insurance No

Purchase Protection Insurance No

Extended Warranty Insurance No

Rental Vehicle Excess In Australia Insurance No

Extras

0.66% cash back for every $1. Capped at $500 p.a.

Overview

bcu Rewards Credit Card

The BCU Rewards credit card has a great low interest rate of 13.05% p.a. on purchases and comes with the added bonus of cashback rewards. Receive 0.66% cashback for every eligible dollar spent. Up to 52 days interest-free on purchases and an annual fee of $89.

Key features

- 13.05% for purchases and 14.80% for cash advances

- Receive 0.66% cash back for every eligible dollar. You can use it towards your next credit card or home loan repayment or transfer the cash back into your bcu transaction or savings account.

- Up to 52 days interest-free

- $89 annual fee

- To apply for a bcu credit card you must be:

18 years of age or older; A permanent Australian resident or citizen; not have any outstanding defaults, judgements or an un-discharged bankruptcy or have only been un-discharged from bankruptcy for less than 2 years.

Minimum criteria to apply for this card

-

Be over 18 years old

-

Good Credit and have not applied for multiple credit cards recently

-

Resident or citizen of Australia

You have your personal details ready to complete the online application

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Arthur

17 April 2020Great card

Recommends this card