Credit card travel insurance covers the cardholder and often additional cardholders, spouses and dependents as well. You'll usually need to pay for your travel on the card to activate the insurance, so it's important to read the PDS to make sure you're covered for your trip.

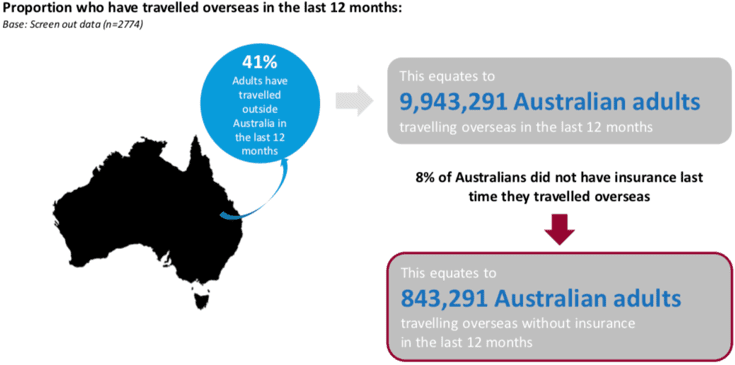

According to a survey carried out by the Insurance Council of Australia and the Department of Foreign Affairs and Trade, 8% of Australian adults travelled outside Australia without insurance in the previous 12 months, while 31% did so in the previous three years. Unfortunately, that’s not the only problem the survey picked up.

Apparently, for those travellers who do take the time to buy travel insurance, many neglect to check whether the policy they choose actually offers the cover they need. Around one-third simply pick the policy that’s cheapest without reading the small print, and more than half do not look at their exclusions.

So, how much of a problem is this? Well, the survey showed that 41% of Aussies travelled overseas within the previous 12 months, which works out to be just under 10 million travellers. If 8% of those were uninsured, that means just under 850,000 Australian adults took a trip outside the country without proper cover to protect them if something bad happened.

source: https://smartraveller.gov.au/guide/all-travellers/insurance/Documents/survey-travel-insurance-behaviour-web.pdf

Let's look at how credit card travel insurance works.

| COVID-19 Cover: for more information about COVID-19 cover on credit card travel insurance, click here. |

Is credit card insurance really ‘complimentary’?

Technically, yes, the insurance is free. However, these kinds of extras are usually found on credit cards with higher annual fees or higher interest rates.

You might also need to spend a certain amount on your travel for the insurance to activate. For instance, it's typical to need to spend at least $500 on your card on flights, car hire or accommodation.

If you meet all the eligibility criteria, travel insurance is a great perk that can save you money every time you travel.

Should you choose a credit card simply for the insurance offered?

If you're a frequent traveller then complimentary travel insurance can help offset costs on your trips. Since travel insurance is usually found on cards with other travel extras, it could be a good 'package deal' that saves money on insurances, foreign fees, and gives flight discounts or earns rewards points.

It's important to read the terms if you know you're going to be using the complimentary insurance. Make sure you meet the eligibility criteria for age (most insurances don't cover you if you're over 80 years old) and that it covers any family members who travel with you.

Pros and Cons

Pros

- You may be able to save money, especially if you are a frequent traveller.

- The cover offered may be similar to standalone cover.

- You can save time comparing standalone cover for each trip you take.

- The policy may cover your family if they are travelling with you (as long as you activate the policy correctly).

- Your policy may offer cover for a range of international destinations, whereas the cost for standalone cover may vary according to where you travel.

Cons

- As credit card travel insurance is considered a premium feature, you may pay higher annual fees and interest.

- Activation of travel insurance varies by card. You may have to spend a certain amount or pay for your entire trip using your card for the insurance to activate.

- Cover varies. Your policy may offer cover overseas only, or within Australia only.

- If you don’t travel that often, you may not get that much value from the insurance offered. You might find you're paying more in annual fees and interest and not getting the returns from perks like insurance.

What is credit card travel insurance?

Credit card travel insurance is a feature offered on some credit cards, and is usually designed to attract new cardholders. Working in much the same way as standalone travel insurance, this added extra can offer cover while travelling overseas or at home, covering events such as travel delays, lost luggage and medical emergencies.

Similar to standalone travel insurance, credit card travel insurance offers varying levels of cover. The cover provided typically depends on the credit card, with higher-end credit cards – generally those that have higher annual fees – often providing higher levels of cover. That means, before relying on credit card insurance, it’s important to understand what’s covered – and what’s not.

Some credit card travel insurance policies will only offer cover for the primary cardholder, while other policies offer cover for family members travelling with the primary cardholder, and any additional cardholders. What’s important to understand here is what is required to activate that cover for each trip.

What does credit card insurance offer?

So, why would you choose credit card travel insurance? To answer that, let’s ask why you would purchase any type of insurance. Buying insurance allows us to protect ourselves in case something bad happens. By choosing a credit card with travel insurance that offers suitable cover for your needs, you can protect yourself should something bad happen to you while travelling.

Of course, this also offers you peace of mind. For some people, travelling can be stressful. Whether it’s the stress of remembering to pack everything you need, the fear of flying, or the worry associated with going into the unknown, taking a trip can cause anxiety. Having the right insurance, however, can help to remove some of that stress, knowing it’s there as back-up.

Credit card travel insurance can also save you money. Instead of paying for standalone insurance for each trip you take, or annual cover each year, you could benefit from having the cover you need included in your credit card. Of course, you are likely paying an annual fee for that credit card, but if you choose the right card, the value of the features on offer should outweigh the cost of that annual fee.

Lastly, credit card travel insurance can save you something very precious indeed: time. If every time you take a trip, you have to compare standalone travel insurance policies, those hours will really stack up. Instead, with credit card travel insurance that you know and trust, you could enjoy cover on each and every trip, without all that comparison time.

What does credit card travel insurance cover?

If you have spent time comparing standalone travel insurance policies, you’ll know that there are different levels of cover: basic, mid-range and comprehensive. The same can apply to credit card travel insurance. Just as with standalone cover, the more cover offered, the more expensive it tends to be.

Basic credit cards with lower annual fees may offer basic travel cover, mid-range cards with slightly higher annual fees may offer mid-range cover, while premium cards with even higher annual fees may offer something more like comprehensive cover. However, it’s worth pointing out that this is not always the case, so you need to compare the options and read the product disclosure statement (PDS) to find out exactly what cover is provided.

Cover and limits will vary from card to card, but you may find credit card travel insurance offering:

- Emergency medical expenses while travelling overseas.

- Loss, theft and damage cover for luggage and other personal belongings.

- Compensation for unavoidable trip cancellation or missed connections.

- Compensation for delay, such as delayed flights.

- Car rental insurance excess waiver (this mostly covers car hire overseas only, but some policies cover this in Australia as well).

- Accidental death, permanent disability or loss of income.

- Personal liability while travelling.

As we mentioned previously, some credit card travel insurance will only cover the primary cardholder, while other more comprehensive policies may cover additional cardholders, and partners and dependents travelling with the primary cardholder.

How does credit card travel insurance vary?

One of the most important things to think about when choosing travel insurance of any kind is suitability. There’s no point in having cover if it doesn’t actually cover you. When assessing the level of cover, it can be helpful to check out the following factors:

- Trip duration: How many days of travel will it cover? This includes looking at the number of days each trip can be, as well as how many days per year can be spent overseas.

- Medical expenses: Is there a limit on the amount that will be paid out in the event of a medical emergency? What other medical events are covered and what are their limits? Do you have any pre-existing conditions, and will they be covered?

- Luggage: Does it cover lost belongings, or only those that are stolen or damaged? What limits apply? Will it be enough to cover everything in your suitcase if it goes missing? What about high-cost items such as jewellery and electronics?

- Cancellations: If the policy covers cancellations, what is the policy regarding cancellation fees?

- Activities: What activities do you plan on doing overseas – and are they covered? Activities such as snow sports may require additional cover.

It’s also worth remembering that some credit cards offer travel insurance plus extras such as travel accident insurance and travel inconvenience insurance. On the other hand, some cards only offer accident and inconvenience insurance, and others only offer travel insurance. So what’s the difference?

- Travel insurance: Travel insurance offered on credit cards usually only covers overseas travel, however, some also cover travel within Australia. Travel insurance typically covers overseas medical emergencies, lost or damaged goods, cancellation fees, rental vehicle excess, accidental death and more.

- Travel accident insurance: This type of insurance generally covers accidental death and injury incurred as a passenger on transport such as a plane, bus, train or ferry.

- Travel inconvenience insurance: This type of insurance generally covers typical ‘inconvenient’ travel events, such as flight delays, lost luggage, or forced arrangement cancellations. It may also cover funeral expenses in the case of accidental death while travelling.

Who would get the most out of credit card travel insurance?

There are many different types of traveller. While some love luxury, others prefer to keep things simple. While some can’t get enough of package holidays, others want to get off the beaten path. So, which type of traveller would benefit most from credit card travel insurance?

Frequent travellers may benefit greatly from credit card travel insurance, especially if they would typically use their credit card to cover their travel costs. These travellers can save time comparing standalone policies for every trip they take. They may also enjoy more opportunity to travel, with more days covered per year compared to standalone annual cover.

Money savers may also benefit from credit card travel insurance. Instead of paying extra for standalone insurance, these frugal types can enjoy cover included on their credit card. While they may be paying an annual fee for their credit card, if they have chosen wisely, they should be getting more back from the card’s features than they are paying out in annual fees.

Time-poor travellers can also reap the benefits of credit card travel insurance. We all know life is busy. For some people, comparing travel insurance options every time they go overseas takes too much time out of their busy schedules. Instead, they can check out the options for credit card insurance once, understand what cover they’ve got, to rely on that for all future travel.

People travelling with their partners or family could also benefit from credit card travel insurance. Instead of spending time and money sorting out cover for their partner or dependents when taking a trip, the right credit card travel insurance could cover them too.

Senior travellers may benefit from credit card travel insurance, as limits and exclusions can differ between standalone and credit card cover. Some credit card travel insurance policies can continue to offer cover for travellers as they age, while standalone policies may charge more in premiums for more elderly travellers.

Travellers visiting different destinations may save money with credit card travel insurance. While standalone cover typically charges higher premiums to visit countries such as the United States, credit card travel insurance can provide cover to those insured no matter where they go (some exclusions apply).

Finally, those who simply don’t get round to buying travel insurance may benefit most from credit card travel insurance. As long as they activate their cover properly, they could enjoy cover when they need it, without putting in the effort of finding and buying cover before leaving home. According the ICA study, failing to think about it was the biggest reason for not having travel insurance.

How does credit card travel insurance work?

Understanding how your credit card travel insurance works is essential. If you don’t understand how it works, not only will you not know what your policy covers, you will also not know how to activate your cover, or how to make a claim when the time comes.

Choose the right card

The process of understanding your credit card travel insurance starts with choosing the right credit card. While it may take time, read the PDS carefully to ensure you choose the policy that provides the cover you need, taking time to note how cover is activated and how claims are made.

Activate your cover

How you activate cover varies from card to card. Generally credit card travel insurance is activated in one of four ways:

- Purchase: You could activate your cover by making a travel purchase on your card. This may involve spending a certain dollar amount, covering a certain percentage of the travel costs, or purchasing a return ticket with your card.

- Rewards point purchase: You may be able to activate your credit card’s travel insurance by making travel purchases with your rewards points.

- Notification: Some cards simply require a notification of your travel plans to activate the cover on that trip. As an example, CommBank credit cards provide base travel cover, but cardholders can benefit from higher levels of cover by activating their policy prior to travel.

- Book travel through a specific service: Cards that offer a dedicated travel service may offer cover activation by booking travel using that service. The Citi Travel Program is one example of this.

Make a claim

According to the ICA study, only half of those who experience an insurable event actually claim on their travel insurance. While this certainly seems to make the process of getting cover in the first place fairly pointless, it is still important to understand how to make a claim should you need to make one.

Again, this info should be in the PDS, however, claims typically need to be made directly with the insurance underwriter, not the credit card provider. It’s a good idea to take your policy details with you when you travel, as this will allow you to contact the underwriter when required to find out what you’ll need to make a claim, and what steps to take next.

Which cards offer credit card travel insurance?

As credit card travel insurance becomes an increasingly popular feature, it is found on more and more credit cards. You can find travel insurance included on frequent flyer credit cards, rewards cards and premium cards, as well as more basic options. It may be the case that basic cards offer more basic cover, but that may be exactly what you’re looking for.

Check out a great range of credit cards currently offering complimentary travel insurance on CreditCard.com.au.

Is it really complimentary?

Credit card travel insurance is often referred to as complimentary credit card travel insurance. But, is it really complimentary? It really depends on the way you think about credit cards and the features they offer. When you apply for a credit card, you typically get all the features on offer, included as the package, for which you pay an annual fee each year.

So, if the card includes a personal concierge, you get that personal concierge as a service offered on the card. The same applies for hotel stays, airport lounge access, travel insurance or any other feature offered. These services are ‘complimentary’ because, as a cardholder, you don’t pay any more for them, as they are included in the card’s range of features.

You may say that they are not complimentary because you are paying an annual fee for them. But, what we try to convey to all cardholders is the importance of choosing a credit card that gives more value in features than they pay in annual fees. By working out the value of the features they use, they can calculate whether that annual fee is worthwhile paying.

If you find a credit card offering travel insurance that provides the cover you need, you then save a certain amount of money on standalone travel insurance. Add that to the value of any other features on offer – that you actually use – and weigh that against the annual fee of the card. In this way, you can see whether those complimentary features really are ‘complimentary’.

What should you look out for when choosing credit card insurance?

When comparing credit cards with travel insurance, it can help to split your search in two parts. First, you may want to focus on the travel insurance side, looking at the various credit cards on offer by comparing their travel insurance offerings. Obviously, if travel insurance is just a nice extra for you, you can focus on the credit card itself first, to then look at the insurance on offer.

If you are comparing credit card travel insurance, here are some important factors to compare and contrast. All this info should be included in the card’s PDS.

- Limitations: Check whether there are any limitations on the cover that may affect you or your family.

- Duration: Look at the number of days covered on each trip, and within the year.

- Pre-existing conditions: If you have any pre-existing conditions, check what’s covered on the policy. Ones to watch out for include pregnancy and mental health conditions.

- Activities: Find out which activities are covered. If there are activities excluded from the cover, check whether you can add them at an extra cost.

- Excess: Some policies charge an excess to make a claim. Factor this cost into your calculations to work out whether it still offers good value.

- Exclusions: Be on the look out for any exclusions on the policy. These may include certain types of travel, certain destinations, or exclusions regarding the profile of the traveller.

- Age restrictions: Check if there are any age restrictions on the policy. If the policy covers family members, ensure they are covered within any age limits.

- Level of cover: Find out the dollar amount on each type of claim, for example on medical claims, belongings and so on. Work out what kind of cover you would need, and consider whether the cover offered is sufficient.

- Activation: Make sure you understand how the policy is activated. For example, if you need to purchase your flights on your card to activate the cover, but you wouldn’t normally pay with that card, this may cause problems.

- Claims process: Look at what you need to do to make a claim. Think about the ease of the claims process, how contactable the underwriter is, and what proof is needed to make a claim.

Looking a bit closer at some of those points, we’ll start with pre-existing medical conditions. These often trip travellers up, with both standalone insurance and credit card cover. A pre-existing medical condition is generally one that you are currently being treated for, or have been diagnosed with by a professional prior to the start of your trip. Common examples include:

- Pregnancy

- Diabetes

- Hypertension (high blood pressure)

- Asthma

- Ongoing dental work

- Anxiety

- Alcoholism or drug addiction

- Psychological and psychiatric conditions

If you are unsure, check with the underwriter before you rely on the cover. Depending on the condition, you may still be able to benefit from coverage for any unexpected events that relate to it. You may find more info in the PDS as well, outlining specific coverage options for various pre-existing conditions, sometimes with an option to pay more for coverage on an upgraded policy.

As for claims in general, these can provide a common sticking point for travellers holding either credit card travel insurance or standalone cover. According to a recent survey, almost half of all Australian travellers who could have made a medical-related travel insurance claim couldn’t be bothered to follow through on it. Why?

Forty-four per cent said they were unhappy with the amount of paperwork involved, 32% said only part of their claim was reimbursed the last time they claimed, and 31% blamed lengthy settlement times. If you are concerned about the claims process on your prospective policy, it may help to read online reviews of customers’ past experiences with that specific insurer.

Frequently Asked Questions

Frequently Asked Questions

What should you be aware of when comparing credit card insurance?

Double-check these factors before applying for a card, especially if you're expecting to use the travel insurance for a trip.

- Activation and eligibility: Cover is activated in different ways. Some require a minimum spend on the card, some need a return ticket. Some activate automatically while others need an online request. The PDS will tell you how to make sure you're covered.

- Length of travel: Check how long the standard cover goes for. It could be 2 weeks, 30 days or 6 months. Some need a specific request for longer cover.

- Excess: Whether excess is payable depends on the card and the cover policy. Think about how much you are willing to pay in excess, and whether the policy still offers value if you have to make a claim.

- Terms and conditions: It's tedious, but important that you read the terms and conditions in full. Do this before you rely on the cover – not after you want to make a claim.

Which credit cards offer complimentary credit card insurance?

There's a wide range of credit cards that offer travel insurance, including low-cost cards. It's more common to find it as a perk on premium cards, specifically ones that focus on travel. That includes frequent flyer cards, rewards cards and platinum cards.

How do you make a claim on your credit card insurance?

Credit card travel insurance is backed by an underwriter, not the credit card provider. For instance, Allianz is the underwriter for NAB and Westpac insurance cover.

You'll find details on making a claim in the credit card insurance PDS. It's a good idea to know how to make a claim before you travel, just in case.

How do you choose the right credit card with the right travel insurance?

That's a very big question! Firstly, think about what you need from the card, and how you will use it. If you're looking for travel rewards, look through some of the best frequent flyer credit cards. Then compare the different features: travel insurance, lounge access, flight vouchers, flight delay cover and rewards points.

Another factor to consider is currency conversion fees and rates, if you plan to use the card while overseas. Some cards waive conversion fees altogether.

Is credit card travel insurance the same as regular insurance?

We get asked this one a lot. Travel insurance on a credit card is underwritten by the same insurers that you would take out a standalone policy with (for example, Allianz, Zurich or Chubb Insurance). So, there isn't a whole lot of difference.

You'll likely be covered for the same medical, emergency, transport and death cover that a standalone policy would. Just remember that some high-risk activities aren't covered by any insurers, such as skiing. You'll need add-on cover for that.

If you're comparing credit card insurance to standalone insurance, just make sure to consider:

- Who is covered: credit card insurance usually covers you, additional cardholders and family members.

- What is covered: credit card insurance sometimes covers rental vehicle excess, flight delays, lost baggage and trip cancellations as well.

- Limitations and exclusions: credit card insurance can be more inclusive of seniors, with some cards offering optional extras for those over 79. It also rarely comes with extra costs for travelling to certain destinations, unlike standalone insurance.

What other types of insurances are there on credit cards?

Included travel insurance with your credit card isn't the only type of insurance available. You'll also find cards with:

- Car Rental Excess Insurance. Hate paying excess if you have a fender bender in a rental car? This type of car rental cover insurance will cover the excess on the insurance if things go wrong.

- Price Protection Guarantee. If you've ever bought something and then seen it cheaper next week, price protection cover could pay you the price difference.

If you want to check out other credit card insurances, you can check if you're covered.

Always check the PDS to make sure you're fully covered and your insurance is activated before you travel. I know I've repeated that over and over again, but it's really important with insurance cover.

Credit cards with included COVID-19 cover

These banks have released updates to include limited cover for pandemics and epidemics. Click to see the details of cover for each brand:

- American Express

- ANZ

- NAB

- Latitude 28° Global Platinum Mastercard (limited time offer)

- Bendigo Bank

- St. George

- Westpac

- Bank of Melbourne

- BankSA

- Bankwest

- HSBC

- CommBank

- BOQ

- Qantas Money

Until early this year, no credit card travel insurance covered events caused by COVID-19, meaning you had to cross your fingers and hope borders stayed open and you stayed well.

Now, most major credit card providers have jumped on the COVID-19 bandwagon, which is great to see since it gives a little more peace of mind around travelling. We've put together a rundown of each credit card and its coronavirus policy, but always check the card's PDS since it can change quickly.

Interestingly, some providers like ANZ and St. George have changed their terms to include all pandemic/epidemic disruptions from now on. Let's hope we don't need that anytime soon.

Remember, terms, conditions and exclusions apply to travel insurance. Check the PDS for more information.

American Express

Amex has included a clause in its credit card travel insurance PDS that provides limited cover related to COVID-19:

Amex has included a clause in its credit card travel insurance PDS that provides limited cover related to COVID-19:

Domestic return trips:

- you can change, curtail or cancel your return trip if you, your travel buddy or the person you were visiting test positive for coronavirus.

- You aren't covered if you need to cancel or reschedule because borders closed or travel advisory warnings are put in place.

- If you become unwell with coronavirus while travelling, you can claim under Medical Emergency Expenses cover (not valid while a 'do not travel' warning is in place)

International return trips:

- you can change, curtail or cancel your return trip if you, your travel buddy or the person you were visiting test positive for coronavirus.

- You can be covered if borders close or a travel advisory warning is issued for the country you're visiting.

- You won't be covered if Australia issues a 'do not travel' warning.

- You won't be covered if the borders at your destination are already closed.

- If you become unwell with coronavirus while travelling, you can claim under Medical Emergency Expenses cover (not valid while a 'do not travel' warning is in place)

Amex credit cards with complimentary travel insurance including COVID-19 cover:

- American Express Platinum Edge

- American Express Platinum Charge Card

- American Express Explorer

- American Express Velocity Platinum

- Qantas American Express Ultimate

- Qantas American Express Premium

ANZ

ANZ credit cards with complimentary travel insurance now include coverage for pandemic and epidemic disruptions and illnesses, including COVID-19.

ANZ credit cards with complimentary travel insurance now include coverage for pandemic and epidemic disruptions and illnesses, including COVID-19.

Claims related to pandemics/epidemics:

- if you or any dependents covered by the travel insurance test positive to COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Cancellation, Additional Expenses, Evacuation & Repatriation, and Overseas Emergency Assistance cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- There is no mention of coverage if you're prevented from travelling by border closures or travel warnings.

- You aren't covered if you travel to a destination with a travel advice warning by the Australian government.

ANZ credit cards with complimentary travel insurance including COVID-19 cover:

- ANZ Frequent Flyer Platinum

- ANZ Frequent Flyer Black

- ANZ Rewards Platinum

- ANZ Rewards Travel Adventures Card(Discontinued)

- ANZ Rewards Black

- ANZ Platinum Credit Card

NAB

NAB has updated its complimentary travel insurance to include some coverage for COVID-19, effective as of March 01, 2025.

NAB has updated its complimentary travel insurance to include some coverage for COVID-19, effective as of March 01, 2025.

Claims related to pandemics/epidemics:

- If you or any dependents covered by the travel insurance test positive to COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

- NAB's travel insurance policy specifically states there are no other pandemic or epidemic-related circumstances covered, which likely includes border closures or other travel restrictions.

NAB credit cards with complimentary travel insurance including COVID-19 cover:

- NAB Low Fee Platinum(Discontinued)

- NAB Qantas Rewards Signature

- NAB Rewards Signature

- NAB Qantas Rewards Premium

- NAB Rewards Platinum

Latitude 28° Global Platinum Mastercard

Latitude 28° had a limited-time travel insurance offer that included COVID-19 cover for its Global Platinum card. The offer ended 31 July 2022, and we've kept the information here for customers.

Latitude 28° had a limited-time travel insurance offer that included COVID-19 cover for its Global Platinum card. The offer ended 31 July 2022, and we've kept the information here for customers.

Claims related to COVID-19:

- Cover applies to you and your 'family', which includes you, your spouse and up to 3 eligible children

- You can claim up to $700,000 per person in medical costs if you need treatment for COVID-19 during an overseas covered trip

- You may be covered for travel and accommodation deposits if you contract COVID-19 on a covered trip and a doctor certifies you're unfit to travel

- If you have to quarantine just before departure because you've tested positive to COVID-19, you may be covered for administrative costs (but not any other additional costs related to your quarantine)

- You're not covered for any additional costs such as accommodation or flights because of borders closures or travel disruptions

Bendigo Bank

Bendigo Bank credit cards with complimentary travel insurance now include coverage for pandemic and epidemic disruptions and illnesses in its PDS, including COVID-19.

Bendigo Bank credit cards with complimentary travel insurance now include coverage for pandemic and epidemic disruptions and illnesses in its PDS, including COVID-19.

Claims related to pandemics/epidemics:

- If you or any dependents covered by the travel insurance test positive to COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Cancellation, Additional Expenses, Evacuation & Repatriation, and Overseas Emergency Assistance cover.

- If you become ill with COVID-19, you may be able to claim Overseas Emergency Medical cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- There is no mention of coverage if you're prevented from travelling by border closures or travel warnings.

- You aren't covered if you travel to a destination with a travel advice warning by the Australian government, even if you have an exemption or permission from the Australian government to travel

Bendigo Bank credit cards with complimentary travel insurance including pandemic cover:

St. George

St. George has updated its complimentary travel insurance to include some coverage for COVID-19, effective as of March 01, 2025.

St. George has updated its complimentary travel insurance to include some coverage for COVID-19, effective as of March 01, 2025.

Claims related to pandemics/epidemics:

- If you or any dependents covered by the travel insurance test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- If you or your companion become so sick with COVID-19 that can't continue travelling, you may be reimbursed for additional accommodation and travel expenses.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

St. George credit cards with complimentary travel insurance including pandemic and epidemic cover:

- St. George Amplify Platinum

- St. George Amplify Platinum - Qantas

- St. George Amplify Signature

- St. George Amplify Signature - Qantas

Westpac

Westpac has updated its complimentary travel insurance to include some coverage for current and future pandemics and epidemics, including COVID-19, effective as of March 01, 2025.

Westpac has updated its complimentary travel insurance to include some coverage for current and future pandemics and epidemics, including COVID-19, effective as of March 01, 2025.

Claims related to pandemics/epidemics:

- If you or any dependents covered by the travel insurance test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- If you or your companion become so sick with COVID-19 that can't continue travelling, you may be reimbursed for additional accommodation and travel expenses.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

Westpac credit cards with complimentary travel insurance including pandemic and epidemic cover:

- Westpac Altitude Black

- Westpac Altitude Black - Qantas

- Westpac Altitude Platinum

- Westpac Altitude Platinum - Qantas

- Westpac Business Choice Rewards Platinum Mastercard

- Westpac Altitude Business Platinum

- Westpac Altitude Business Gold Mastercard

Bank of Melbourne

Bank of Melbourne has updated its complimentary travel insurance to include some coverage for current and future pandemics and epidemics, including COVID-19, effective as of March 01, 2025.

Bank of Melbourne has updated its complimentary travel insurance to include some coverage for current and future pandemics and epidemics, including COVID-19, effective as of March 01, 2025.

Claims related to pandemics/epidemics:

- If you or any dependents covered by the travel insurance test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover may be available under Cancellation and Additional Expenses.

- If you or your companion become so sick with COVID-19 that you can't continue travelling, you may be reimbursed for additional accommodation and travel expenses.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

Bank of Melbourne credit cards with complimentary travel insurance including pandemic and epidemic cover:

- Bank of Melbourne Amplify Platinum

- Bank of Melbourne Amplify Platinum - Qantas

- Bank of Melbourne Amplify Signature

- Bank of Melbourne Amplify Signature - Qantas

- Bank of Melbourne Amplify Business

BankSA

BankSA has updated its complimentary travel insurance to include some coverage for current and future pandemics and epidemics, including COVID-19, effective as of March 01, 2025.

BankSA has updated its complimentary travel insurance to include some coverage for current and future pandemics and epidemics, including COVID-19, effective as of March 01, 2025.

Claims related to pandemics/epidemics:

- If you or any dependents covered by the travel insurance test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If you become ill with COVID-19, you may be able to claim Overseas Medical Emergency cover.

- If your travel buddy becomes ill with COVID-19, cover may be available under Cancellation and Additional Expenses.

- If you or your companion become so sick with COVID-19 that you can't continue travelling, you may be reimbursed for additional accommodation and travel expenses.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

BankSA credit cards with complimentary travel insurance including pandemic and epidemic cover:

- BankSA Amplify Platinum

- BankSA Amplify Platinum - Qantas

- BankSA Amplify Signature

- BankSA Amplify Signature - Qantas

Bankwest

Bankwest has now updated its credit card travel insurance PDS to provide limited cover related to COVID-19. Take note, this cover only includes limited medical cover:

Bankwest has now updated its credit card travel insurance PDS to provide limited cover related to COVID-19. Take note, this cover only includes limited medical cover:

Claims related to pandemic/epidemic cover:

- If you test positive for Covid-19 you may be able to access Overseas Medical Emergency and Hospital Expenses cover.

- You aren't covered if you don't take appropriate action to avoid countries with a 'do not travel' warning advised by the Australian government or mass media.

- You will not be covered for flight cancellations, accommodation or any other travel expenses.

- You will not be covered for anything Covid-related on a cruise.

Bankwest credit cards with complimentary travel insurance including COVID-19 cover:

- Bankwest Breeze Platinum Credit Card

- Bankwest Zero Platinum Credit Card

- Bankwest More World Mastercard

- Bankwest Qantas World Credit Card

- Bankwest Qantas Platinum Credit Card

- Bankwest More Platinum Credit Card

HSBC

HSBC has included a clause in its credit card travel insurance PDS that provides limited cover related to COVID-19:

HSBC has included a clause in its credit card travel insurance PDS that provides limited cover related to COVID-19:

Claims related to pandemics/epidemics:

- If you test positive for COVID-19, or any illness recognised as a pandemic/epidemic, you may be able to claim the Overseas Emergency Assistance, Overseas Emergency Medical, Medical Evacuation & Repatriation, Cancellation, and Additional Expenses cover.

- If your travel buddy becomes ill with COVID-19, cover is available under Cancellation and Additional Expenses.

- You aren't covered if you don't follow advice or warnings when travelling to a destination; for example, a 'Reconsider your need to travel' or 'Do not travel' alert from the Australian government, or published by a reliable media source.

- You aren't covered if borders close during your trip.

HSBC credit cards with complimentary travel insurance including COVID-19 cover:

- HSBC Platinum Card - 0% Balance Transfer Offer

- HSBC Premier Credit Card

- HSBC Platinum Qantas Credit Card

- HSBC Credit Card

CommBank

CommBank has included a clause in its credit card travel insurance PDS that provides limited cover related to COVID-19:

CommBank has included a clause in its credit card travel insurance PDS that provides limited cover related to COVID-19:

Claims related to pandemics/epidemics:

- If you test positive for Covid-19 you may be able to access Overseas Medical Emergency and Hospital Expenses cover.

- You aren't covered if you don't take appropriate action to avoid countries with a 'do not travel' warning advised by the Smart Traveller website (excluding Australia and New Zealand).

- You will not be covered for flight cancellations, accommodation or any other travel expenses.

- You will not be covered for anything Covid-related on a cruise.

BOQ

BOQ has updated its credit card travel insurance PDS to cover COVID-19 in a limited capacity:

BOQ has updated its credit card travel insurance PDS to cover COVID-19 in a limited capacity:

Claims related to COVID-19:

- You may be covered for costs incurred from having to cancel, curtail or change your trip because you or your travel buddy contract COVID-19.

- You may be covered for overseas medical emergency expenses on your overseas return trip and transportation of remains if you die from COVID-19 while travelling (it must be confirmed and diagnosed on your trip).

- Besides Trip Cancellation and Amendment Cover and Overseas Medical Emergency Expenses cover, you won't be covered for anything else caused by COVID-19 or any of its variants.

Qantas Money

Qantas was one of the last to come to the Covid party. Its updated travel insurance policy now has limited COVID-19 coverage:

Qantas was one of the last to come to the Covid party. Its updated travel insurance policy now has limited COVID-19 coverage:

Claims related to COVID-19:

- You may be covered for costs incurred from having to cancel, curtail or change your trip because you or your travel buddy contract COVID-19.

- You may be covered for overseas medical emergency expenses on your overseas return trip and transportation of remains if you die from COVID-19 while travelling (it must be confirmed or diagnosed on your trip).

- Besides Trip Cancellation and Amendment Cover and Overseas Medical Emergency Expenses cover, you won't be covered for anything else caused by COVID-19 or any of its variants.

Other credit cards with complimentary travel insurance

Almost all banks and insurance companies have updated their insurance terms to include COVID-19 since 2020. You can find and compare credit cards with free travel insurance here, but always check the terms and conditions to see what you're covered for.

Tips for using complimentary travel insurance

First, always read the PDS carefully. I know, it's like a broken record, but insurances come with a lot of 'but's and 'only if's that could leave you high and dry - and out of pocket - if things go awry. Clauses regarding COVID-19 are still new, so make sure you understand what you're covered for.

Second, make sure you activate your credit card's travel insurance. You'll usually be able to check that it's active via the card's website or by calling customer service.

john cunningham

11 November 2023Pauline

15 November 2023