Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Whether you’re curious about crypto or you’re already heavily invested, you might be considering applying for a crypto card. So, what do you need to know? From crypto credit cards to debit cards, to prepaid cards and beyond, crypto cards come in all shapes and sizes to suit every type of user.

In this post, we’ll unpack everything you need to know, from what crypto cards are currently available in Australia, to what they have to offer – and what may be coming our way soon.

Crypto Visa Card

Up to 5% CRO Reward + No Annual Fee

Free ATM withdrawals. Free and unlimited Priority Pass™ Airport Lounge Access.

What is a Crypto Card?

Let’s start with the basics. What is a crypto card? To answer that, we need to break down the various types of crypto cards currently available.

-

- Crypto Credit Cards: With this card, the card provider extends you a line of credit dependent on your creditworthiness. As such, it works in much the same way as any other type of credit card. You buy stuff using the card, and pay back what you owe, with interest applied according to the card’s terms. The big difference lies in the way you earn rewards. Instead of earning points to redeem within the card’s rewards program, you earn cryptocurrency, typically at a tiered percentage rate depending on the type of card you hold.

-

- Crypto Debit Cards: Just as your regular debit card is linked to your everyday account, your crypto debit card is linked to your crypto wallet. In this way, you can use your crypto debit card to pay anywhere regular debit cards are accepted, whether that’s online or instore, or withdrawing cash at the ATM. When you use the card, it draws on your crypto balance to fund the transaction, converting it into fiat currency at the card’s exchange rate. Depending on the card, you may be able to earn crypto rewards on your spending.

-

- Crypto Prepaid Cards: Using a prepaid crypto card, you preload funds onto the card from your crypto wallet. These funds are converted into the fiat currency of your choice, allowing you to access them as you like, funding transactions instore or online, or at the ATM. Like a regular prepaid card, you can only use the funds available on the card, however, most cards make it easy to load funds when needed, with real-time transfers available. Earning crypto rewards on your transactions may be an option.

Depending on the card provider and the card you choose, you may receive a physical card, a virtual card, or both. The physical card will look much like a regular credit card or debit card, offered either in plastic or metal, to be used when paying in person. The virtual card would be held within your digital wallet, to be used online or in person via your device.

How are Crypto Payments Processed?

When it comes to crypto credit cards, the ‘crypto’ part really only relates to the crypto rewards you earn on your card spending. The card itself is funded by the line of credit provided to you by the card provider. That means, when you use the card day to day, you are funding those transactions with your line of credit in fiat currency, rather than cryptocurrency.

Crypto debit cards and prepaid cards work slightly differently. With these cards, cryptocurrency is drawn from your crypto wallet and converted into fiat currency at an exchange rate determined by the card. You then spend or withdraw the fiat currency as required, using the Visa, Mastercard or EFTPOS network.

As such, crypto cards don’t allow cardholders to spend in cryptocurrency directly. Although that may change in the near future, with both Visa and Mastercard putting direct-spend crypto trials into place this year. Depending on how those trials pan out, crypto cards – and their offering – may expand dramatically here in Australia, and overseas.

Pros & Cons of Crypto Cards

Time to weigh up the pros and cons of crypto cards. As crypto credit cards work in a very different way to crypto debit and prepaid cards, we’ll focus on the pros and cons of earning crypto rewards first, to then check out some important factors to keep in mind when choosing crypto credit, debit and prepaid cards.

Earning Crypto Rewards

- With a crypto rewards card, you can earn cryptocurrency on your everyday spending. As long as the value of crypto you earn in rewards is more than you pay out in fees, the card could offer real value.

- If you’re not familiar with the world of crypto, opting for a card that earns crypto rewards could simplify things as you dip your toe in the water.

- Unlike standard rewards, the value of crypto rewards may increase over time. In this way, your earned crypto balance can act as an investment that you add to day by day, simply by using your card.

- You may be required to stake a certain amount of cryptocurrency to receive a crypto debit card or prepaid card. Typically, the higher the stake, the greater the rewards and extras on offer. The stake you put up works to support the network, but essentially ties up your capital.

- Cryptocurrency can be volatile. While the value of your crypto rewards may increase, it may also decrease. Bitcoin is an excellent example of this, with the cryptocurrency’s value regularly rising and falling following nothing more than tweets and comments made by Elon Musk.

- While some crypto rewards will offer real value, others may be limited by the card’s choice of cryptocurrency you can earn in. To calculate the value of the rewards on offer, look at the dollar value of the crypto you will receive on your spend.

- Depending on the card, you may have to pay fees to redeem your rewards for cryptocurrency. This will reduce the value of the rewards you earn.

- Using an exchange to buy and sell crypto, you have control over when the transaction is made. When you earn crypto rewards, the cryptocurrency you earn on each transaction may be processed alongside the transaction, or it may be processed at the end of the statement cycle. This has the potential to vastly alter the value of the rewards you earn.

- There may be tax implications if you choose to sell your crypto rewards. While you won’t be taxed on the rewards you earn, you may be taxed on the capital gain that results from selling rewards that have appreciated in value. This is the same capital gains tax you would pay if you bought and sold crypto for cash through an exchange.

Using Crypto Credit, Debit & Prepaid Cards

- Using a crypto debit card or prepaid card, cryptocurrency becomes more accessible. You can spend your crypto balance in the real world, anywhere regular debit and prepaid cards are accepted.

- Like regular credit and debit cards, crypto cards may offer extras as well as rewards. Depending on the extras on offer, they could work to create more value in the card.

- Unlike a credit card, using a debit card or prepaid card you can only spend what you have available. Depending on the user, this may be seen as either a pro or a con.

- With a crypto credit card, you need to know how to be responsible when accessing credit. Overall, that means spending within your means, always repaying your balance in full each month, and making your repayments on time to avoid fees and negative records on your credit report.

- Debit and prepaid cards that allow you to freely spend crypto go against the HODL (hold on for dear life) ethos that many in the crypto community embrace. Those users believe crypto will be worth far more in the future, so spending it now simply doesn’t make sense.

- There is a distinct lack of choice in the number of crypto cards available to users in Australia. Crypto credit cards are available to waitlisted applicants in the US only. While there is a small selection of crypto debit and prepaid cards offered to Australian residents, most are restricted to users based in the US or Europe.

Crypto Cards in Australia

With that in mind, let’s take a look at the range of crypto cards currently available in Australia to find out what they have to offer. Bear in mind, each of these cards works either as a debit card funded by your crypto wallet, or as a prepaid card that you preload using crypto. We don’t yet have credit cards that earn crypto rewards here in Aus.

The CoinJar Card

The CoinJar Card was released in 2021 and is Australia’s first Mastercard-backed cryptocurrency debit card. You can choose which crypto you want to spend for instantaneous conversion into cash when you tap-and-go or spend online. The CoinJar Card can be added to digital wallets, and has a rewards program that you can enjoy, plus no monthly fees.

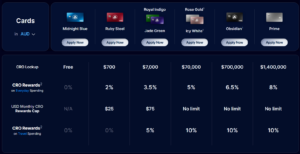

The Crypto.com Visa Debit Card

Perhaps the best-known crypto card available in Australia, the Crypto.com Visa Debit Card is a prepaid debit card that you can top up using cryptocurrency or fiat currency, either via bank transfer or using a credit or debit card. After preloading the card, you can use it in much the same way as any other prepaid debit card, covering transactions in-store and online, or accessing cash at the ATM.

The card supports more than 20 fiat currencies (including AUD, USD, EUR, and GBP), and more than 250 cryptocurrencies (including BTC, ETH, XRP, and CRO). Within your account, you can manage all your fiat and cryptocurrencies using the Crypto.com App.

Crypto Visa Card

Up to 5% CRO Reward + No Annual Fee

No overseas fees. Free and unlimited Priority Pass™ Airport Lounge Access

- Your Travel – In Style: 10% purchase rebate on Expedia or Airbnb booking*

- Your Music: monthly rebate for your standard Spotify subscription plan*

- Your Movies: monthly rebate for your standard Netflix subscription plan*

- Spending Rewards: up to 5% back on spending, local or overseas, no minimum or maximum spending required (*conditions apply)

There’s a lot to unpack with the Crypto.com Visa card. We go into detail on our review page, but here’s the lowdown to get you started. It should be noted that Crypto.com did a huge overhaul of its rewards program in July 2022 which affects existing and new customers – but the rewards are still some of the best available for Aussies.

The rewards and extras offered on this card are tiered according to the number of CRO tokens you stake. The more you stake, the higher the percentage of rewards you’ll earn on your card spend, paid out in CRO (Crypto.com’s native currency). The highest earn rate is currently set at 5%.

Depending on your tier, you may also benefit from extras such as Spotify, Netflix, Amazon Prime, Airbnb, and Expedia rebates. Priority Pass™ airport lounge passes are also available, as are exclusive research reports and priority customer service.

Additional extras include free ATM withdrawals (fees do apply after certain limits) and free currency exchange transactions. You can also get metal cards for a bit of flash.

Is anything else worth noting on this card? Here are the highlights.

-

- To apply for a Crypto.com Visa Debit Card, you will need to stake CRO for a period of 180 days. The number of CRO needed will depend on the tier of card you want to apply for (check our review page for the staked amounts for each tier). Start the process by signing up for a Crypto.com App account, and complete the KYC verification. Then, purchase CRO tokens and deposit them into your Crypto Wallet in the App. Finally, select the card you want in the App’s Card tab and follow the instructions.

-

- When using the card, the rewards you earn will be paid instantly in CRO and deposited into your Crypto Wallet in the Crypto.com App.

-

- Crypto.com states it offers competitive exchange rates for both fiat and cryptocurrencies. The exact rate you receive will depend on your jurisdiction and card tier. Details will be provided to you in the Crypto.com Visa Card Terms and Conditions when you apply for your card.

-

- What about fees and limits? These can all be found in the ‘Fees & Limits’ section under ‘Settings’ in the Crypto.com App. As fees also vary by card tier, be sure to check the correct fee info for your card. Our review page explains some of the fees.

The BTC.com.au ATM/EFTPOS Card

Based in Sydney, BTC.com.au is a privately owned start-up that allows users to buy cryptocurrencies, pay bills, and spend and withdraw crypto funds via its ATM/EFTPOS card.

Using BTC.com.au, you can:

- Buy Bitcoin (BTC) and Ethereum (ETH).

- Pay BPAY bills, transfer funds to Australian bank accounts, and top up your BTC.com.au ATM/EFTPOS Card with Bitcoin, Ethereum, Litecoin (LTC), Bitcoin Cash (BCHABC), OmiseGO (OMG) and Ripple (XRP).

The company advises it is looking to support additional currencies in the near future.

More on the card? The BTC.com.au ATM/EFTPOS card is a prepaid card available exclusively to BTC.com.au customers. It allows users to preload any of the cryptocurrencies mentioned above, to then make purchases using the card via EFTPOS terminals, or to withdraw cash at ATMs. It can only be used within Australia.

It’s worth noting that to use the card, you will need a crypto wallet. BTC.com.au does not offer a wallet service. You can, however, view your balance, load your card with funds, and view your transaction history by logging into the BTC.com.au site.

The fees to use the card are minimal. There are no application fees or postage fees to receive the card. Ongoing, there are no monthly maintenance fees or inactivity fees, there are no load fees or ATM withdrawal fees (although the ATM provider may charge its own fees upon withdrawal).

The Multicurrency Wirex Card

Brought to you by Wirex, the Multicurrency Wirex Card is a multicurrency debit card designed to make crypto more accessible to everyone. Using the card, you can buy, hold, exchange and spend crypto and fiat currencies wherever Visa (soon to be Mastercard) is accepted, with real-time conversion at point-of-sale.

As a rewards earner, the card allows users to earn Cryptoback rewards, paying out up to 8% in WXT every time the card is used in-store and online. The card also has zero exchange fees, so you can instantly switch between your crypto and fiat currencies at over-the-counter and interbank rates, with zero fees to pay.

The CryptoSpend Card

Released in 2021, the CryptoSpend Card is a prepaid card that links to your CryptoSpend wallet, allowing you to load and spend Bitcoin, Bitcoin Cash, Ethereum, Litecoin and XRP. As a service, CryptoSpend touts its ability to allow users to transfer funds to Aussie bank accounts and pay bills, with transfers made almost immediately.

In terms of card features, CryptoSpend offers users control over their card, making it easy to activate, lock and unlock the card, and change the PIN using the CryptoSpend app. Users can also see all of their transactions in one place in-app.

Other Options

Any other crypto cards worth a mention? Here are a few crypto cards that may be available in Australia soon. Some have waitlist options that you can join if you’re interested.

The Bitpay Debit Card is currently available in the US only, but has a waiting list you can join as an Australian resident. The card can be preloaded with crypto and used anywhere Mastercard is accepted.

As far as we could tell, the Binance Visa Card, the Coinbase Card and the Cryptopay Visa Card all offer crypto card services, but are not currently offered to Australian residents. It may be worth digging deeper into these options if you’re interested, as they may create an Aussie offering in time.

How to Compare Crypto Cards

Thinking of applying for a crypto card? Here are some factors to bear in mind as you compare the options.

-

- Type of Card: Do you want a debit card that links to your crypto wallet, or a prepaid card you can preload when needed? As we mentioned before, crypto credit cards aren’t yet available here in Australia, but when they are, this should also be factored into your decision.

-

- Physical or Virtual Card: Some crypto cards may be offered as a physical card, a virtual card, or both. While a virtual card offers benefits such as instant use and integration into the digital wallet you are already using, it can be useful to have a physical card as backup when virtual cards are not accepted.

-

- Supported Currencies: Check which fiat and cryptocurrencies the card supports. You may find a limited range that supports AUD. If your choice of crypto is obscure, again, it may be difficult to find a card that supports it.

-

- Supported Countries: While you may find plenty of crypto cards online, not all will be available to Australian residents. Check the small print carefully to find out if you’re eligible before you apply.

-

- Activation Cost: Find out how much the card provider charges in fees and costs. You may be charged a fee for ordering, delivering and activating your card. Physical cards may cost more than virtual cards in this regard.

-

- Ongoing Fees: Be aware of any ongoing fees that may apply, including loading fees (applied when loading crypto onto the card), monthly service fees, annual fees, currency conversion fees, ATM withdrawal fees and inactivity fees.

-

- Exchange Rate: Find out what exchange rate you will receive when your crypto is converted into fiat currency. You may notice that crypto debit card exchange rates are typically lower than mid-market rates.

-

- Account Management: Consider how easy it will be to manage your card account, track transactions, convert currencies, and load your card. It’s also worth checking whether you will need to use the provider’s wallet, or whether you can link to your current wallet.

-

- Transaction Limits: You may find card providers place certain limits on their cards. Check for loading limits, ATM withdrawal limits, and spending limits.

-

- Provider: Do some research on the provider before you apply. Find out where the provider is based, and how long it has been in business. Take time to check for user reviews, and make sure the provider hasn’t been involved in any scams.

How Do You Apply for a Crypto Card?

Each crypto card has its own application process in place. You will usually have to provide personal details when you apply, backed by some form of identification. You may be able to register anonymously in some cases, with the option provide ID to access higher transaction limits.

After giving the provider the required information, you may have to pay an application or issuance fee. From there, you may receive a virtual card, which can be used straight away, and then a physical card in the post.

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Credit Card Types

Credit Card Fraud Statistics

Tips & Guides

Complete Guide to the Velocity Frequent Flyer Program

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Warren

28 October 2024Pauline

1 November 2024Roy

5 April 2024Pauline

18 April 2024Susan Yeates

5 March 2024Pauline

12 March 2024Susan Yeates

26 February 2024Pauline

1 March 2024Kylie

17 September 2023Pauline

19 September 2023Mr Crypto

25 July 2023jean michel

18 October 2022Pauline

19 October 2022Dave

29 August 2022Pauline

31 August 2022Rosella Carreno

18 August 2022Pauline

18 August 2022Dorothy Hriefi

27 July 2022Pauline

1 August 2022Mel

16 July 2022Pauline

19 July 2022Linda

18 April 2022Pauline

19 April 2022Kath M

20 March 2022Pauline

23 March 2022John

3 March 2022Pauline

4 March 2022wales

14 February 2022Pauline

15 February 2022Dhruv

7 February 2022Pauline

11 February 2022steven goddard

4 December 2021Pauline

7 December 2021Gareth

20 September 2021Roland

21 September 2021Hanane

22 July 2021Roland

23 July 2021