Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

As the coronavirus continues to spread across Australia, it becomes clearer day by day that this pandemic has the potential to affect not just our physical health, but our financial health as well. Not only has the outbreak triggered a wave of social panic causing people to overspend as they panic buy, it has also initiated unprecedented employment disruption and financial market volatility.

What’s the solution? While we certainly don’t have a quick fix, we have come up with nine things you can do to improve your financial health during these uncertain times. From cutting back on unnecessary spending and paying down your credit cards, to understanding the tools you have available and finding help when it’s needed most, we’ll look at what you can do day-to-day to put yourself on the path towards a better financial situation – and a less stressful tomorrow.

What Our Googling Says About Us

With social distancing and self isolation becoming the new norm, people are spending a lot more time at home by themselves. While we have no doubt Netflix’s servers have been kept busy over the past few weeks, Google has also undoubtedly seen its fair share of increased traffic – and a look at its most common search trends show just what users are most interested in.

Over in Italy, while the country remains on lockdown, its citizens seem to be interested in staying entertained, searching for films such as Harry Potter and Carol. However, other trending topics indicate concerns about their employment prospects as they face indefinite lockdown, including ‘cassa integrazione’ (layoffs) and ‘congedo parentale straordinario’ (extraordinary parental leave).

In the US, the most searched for terms included ‘breaking news’, ‘national quarantine’, ‘N95 masks’, ‘NJ [New Jersey] curfew’, and ‘marshall law’, the last term a misspelling of martial law, used to describe the military takeover of a civilian government under emergency conditions.

Meanwhile, in Indonesia, it seems that despite the Indonesian Health Minister claiming last month it was prayer that had protected the country from the outbreak thus far, its citizens are now looking to Google for more practical advice. Searches included ‘Protokol penanganan virus corona’ (coronavirus handling protocol), ‘pencegahan terhadap terjangkitnya virus corona’ (prevention of coronavirus outbreaks), and ‘menjaga kebersihan diri’ (keep yourself clean).

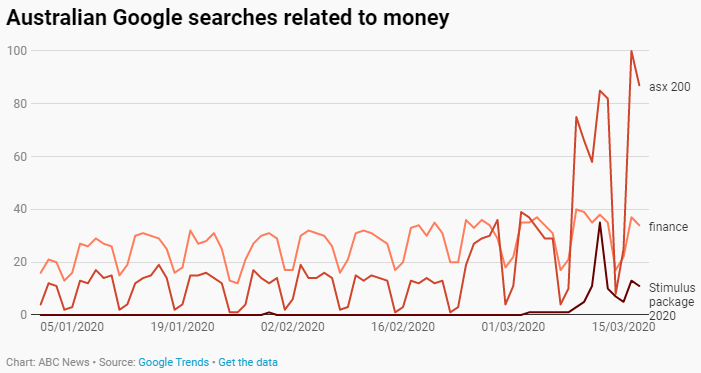

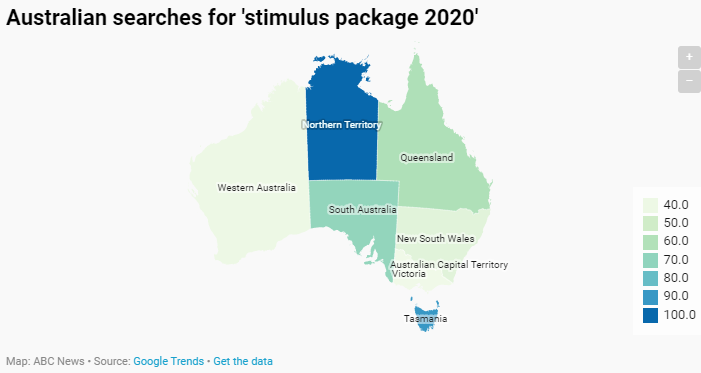

And in Australia? According to Google, Aussies are most concerned about financial matters, with terms such as ‘stimulus package 2020’, ‘ASX 200’, and ‘finance’ featuring highly.

source: https://www.abc.net.au/news/2020-03-22/google-searches-in-the-time-of-coronavirus/12064150

Given the uncertain situation we have now found ourselves in, it’s really no wonder financial matters have become our top concern. So, what can we do to make that situation a little less uncertain? Let’s take a look.

1. Assess Your Financial State

While taking a good, hard look at your finances is somewhat less appealing than lying on the couch bingewatching Netflix, it is essential if you want to know where you stand. So, where do you start?

|

First up, gather together your bank statements and credit card statements (online or on paper), and systematically work your way through each transaction. Note down any regular payments that come out of each account, along with the amount and date. Examples of these may include house and car insurance premiums, gym memberships and subscription services. Create a list of regular payments and calculate the amount spent on them overall each month.

Now, look at all other transactions. These will likely include spending at the supermarket or petrol station, clothes purchases, and money spent on entertainment and eating out. Group these transactions into categories, and create a total for each category. Next, check what funds you have coming in. For the most part, this will be largely made up of your paycheque, however, other income could come from investment properties, shares, or government assistance. If your income is now reduced due to the fact that you are taking unpaid leave or have been made unemployed, adjust these figures accordingly, taking into account any government assistance you may be eligible for. Lastly, assess your savings. Most experts advise having six months or more of your regular living expenses in savings, but for many, that’s simply not achievable. However, if you do have an emergency fund, this could be the emergency those funds have been waiting for. You should also take into account any refunds you may be getting as a result of coronavirus-related cancellations, such as holiday bookings and entertainment tickets. |

2. Start Cutting Back

Now you have a better idea of where you stand financially, you can see where you could make changes that will allow you to cut back and save. Even if your income hasn’t taken that much of a hit and you’re roughly in the same position as you were before the coronavirus started causing chaos, it’s a good idea to cut back where you can to avoid unnecessary spending.

Of course, there will always be things you need to spend money on. You need to buy food for your family, you need to buy petrol for your car, you need to pay the bills. Outside of these areas however, you can think about where you can cut back further. For those of you who may have trouble doing this, cutting back has become somewhat easier since the closure of certain ‘non-essential’ businesses.

- If you usually spend too much on eating and drinking out, this will no longer be a problem now that pubs and clubs have had to close their doors, and restaurants now only offer take-away and delivery services.

- Entertainment spending will also likely decrease with the closure of cinemas, nightclubs and live music venues. Socialising in general has become a no-no, so anywhere you used to go out to spend money is now likely closed.

- Whether you made good use of your gym membership or not, the closure of all gyms and indoor sporting venues will now mean you are spending less on sports related costs too.

- Transport spending will also likely decrease as we are advised against unnecessary travel, and the use of public transport. For those working remotely, their commuting costs – whether that is the cost of running a car or topping up a travel card – will reduce drastically.

- As for other spending, you will likely spend less time browsing at your local Westfield, buying things you probably didn’t need anyway. And as casinos are also now closed, anyone with a penchant for gaming will either need to cut back or head online (not recommended).

What about subscription services? Checking out how much you spend within this category may be something of an eye-opener. According to a survey (1) over in the US, most Americans vastly underestimate how much they spend on subscription services. At first guess, most estimated their average monthly spend was US$79, however, their actual spend was US$237.

Subscription Services You May Have Forgotten You’re Paying For

|

3. ‘Gamify’ Your Budget

Okay, so the concept of budgeting is far from thrilling. Who wants to crunch numbers and look for savings when there are eight episodes of The Witcher to watch after all? If you are having trouble getting into budgeting – whether that’s creating a budget or sticking to it – you may want to try to ‘gamify’ the process.

How does this work exactly? Just as Mary Poppins advocated taking a spoonful of sugar to help the medicine go down, you can make your budgeting more palatable by making a game out of it. Find ways to challenge yourself to spend less over the coming weeks and months, whether that means limiting yourself to a certain number of transactions a month, or setting a spending limit within certain categories and seeing how low you can go.

When you ‘win’ at your budget challenges, you can find free or low-cost ways to reward yourself.

4. Get a Better Deal

Cutting back isn’t all about self-denial. You can also work on cutting back by getting a better deal. The Reserve Bank recently cut rates to 0.5%. But, that doesn’t mean all lenders passed on the cut in full. Check your home loan rate to see how it compares to competitors. You may find that refinancing to benefit from a more competitive rate allows you to save money in both the long and short term.

Before doing this however, there are certain factors to consider, for example, how much equity you currently have in your home. If you own less than 20% of your property, you will have to pay a second round of lenders mortgage insurance if you choose to refinance. You may also have to pay certain fees, and there will be a considerable amount of paperwork to complete. If your employment is in doubt, this will also affect your ability to get approved.

Of course, getting a better deal doesn’t have to mean refinancing your home loan. You could shop around to get a better deal on your internet, your gas or electricity, or your mobile phone plan. What about your credit card? Yep, we’ll be getting to that in two steps’ time.

5. Maximise Your Income

If you want to improve your financial security, you may want to look at ways to supplement your income. If you’re self isolating, you could look for side jobs that allow you to work online from home. Just be aware of potential scams, and make sure you are not paying out money in order to secure a job that sounds too good to be true.

For those willing to work away from home, some sectors are desperately looking for workers. Supermarkets can’t get food on the shelves fast enough, and may be looking for people to help stack shelves and relieve overworked employees elsewhere in their stores. Services Australia has also stated it will hire 5,000 new employees to help with the increased demand, while many insurance companies are recruiting to assist with increased claim volumes.

6. Pay Down Credit Card Debt

Okay, time to talk credit cards. For some, credit cards will become an essential tool that smooths their journey through this crisis. For others, credit cards will only land them in more trouble. So, with that in mind, we’re going to discuss various ways you can make your credit card work for you as times get tougher financially.

First up, balance transfers. If you currently have debts owing on your credit cards, you want your balance to be accruing as little interest as possible as you work on paying down what you owe. One way you can do this is by switching to a balance transfer credit card. Here’s what you need to know to make a balance transfer work for you.

|

If you decide a balance transfer offer isn’t for you – or you won’t get approved for one given your changed financial status – work on paying down your credit card debt strategically. Look at what you owe on each card, how much each charges in interest, and when each payment is due. If you can’t afford to pay even the minimum repayment right now, jump to step 8.

7. Make Use of a 0% Purchase Offer

If you have good credit and you still have income coming in, you may want to consider applying for a card with a 0% purchase offer. With these cards, you pay no interest on your purchases throughout the introductory period. This can help you save on interest month-to-month on spending big and small.

However, as with balance transfer offers, you need to understand how 0% purchase offers work if you want to make one work for you. First up, opt for the longest possible intro period, while keeping in mind important factors such as how much the card will cost you in fees, and whether you meet the card provider’s eligibility requirements.

Secondly, when using the card, try not to overspend just because you know you’re not paying interest on the balance. Think carefully about your spending, and set a budget if needed. You should also create a repayment plan to ensure you pay off all your spending before the intro period ends and your balance starts accruing interest.

8. Reach Out For Help

If your financial situation changes, or you simply find yourself unable to cope, your first step should be to reach out to your financial providers. Many banks and credit card providers are now offering help to those financially affected by the coronavirus, so head online to check out their website or give them a call to chat about your case.

While we were unable to find anything specific regarding credit cards in Australia, over in the US card providers are currently offering relief to cardholders who are finding themselves in financial difficulty because of the coronavirus. For example, Apple Card is allowing cardholders to skip their March credit card payment without being charged interest. Meanwhile, Bank of America is waiving fees, waiving interest for those carrying a balance month-to-month, and increasing credit card limits to allow cardholders to buy necessities without maxing out their card.

We may find that as the situation progresses here in Australia, card providers here will offer something similar. The same may apply to phone providers, utilities providers and others, so if you find yourself struggling, reach out to find out what’s available to you. Most decisions will be made on a case-by-case basis.

And the banks? According to an official Australian Banking Association (ABA) statement, CEO Anna Bligh said “Banks stand ready to support customers and if anyone is in need of assistance, they shouldn’t wait but come forward as soon as possible.”

In terms of the big four, ANZ is currently offering business banking customers:

- A six-month payment deferral on loan repayments for term loans, with interest capitalised

- Temporary increases in overdraft facilities for 12 months

- A 0.25% p.a. decrease in variable interest small business loan rates effective from 27 March, resulting in a 0.50% reduction in March

- A 0.80% p.a. reduction to a new two and three-year fixed rate of 2.59% for secured small business loans up to $1 million, effective 3 April

Meanwhile, home loan customers are being offered:

- Decreased variable interest home loan rates by 0.15% effective from 27 March

- A two-year fixed rate of 2.19% p.a. for owner occupiers paying principal and interest

- Home loan payment deferrals for up to six months (reviewed at three months)

Over at CommBank, home loan customers may be eligible for a six month ‘holiday’ on their mortgage repayments. As for business banking customers, they could benefit from CommBank:

- Deferring repayments and fee waivers on certain products

- Waiving merchant terminal fees for 90 days

- Deferring repayments on vehicle and equipment finance loans, and tailoring restructuring options

- Waiving early redraw fees on business term deposit accounts

- Waiving establishment fees and excess interest on temporary excess products

At NAB, it is offering business banking customers:

- A deferral of business loan repayments and extension of business loan terms (both up to three months)

- Support to restructure existing business loans, including equipment finance

- Business credit card deferred repayments

Lastly, at Westpac, home loan customers can access a three-month deferral on their loan, with the option to extend to another three months on a review-basis after that period. It is also offering special 12-month term deposit rates and reduced fixed home loan rates, available from March 27.

For business customers, Westpac is offering:

- Fee-free redraws on loans

- Business loan and credit card repayments deferred by up to three months

- Options to extend business loan terms by up to three months

- Restructuring and consolidating loans

- Access to term deposit funds without reduction in interest rates

- Overdraft reduction by 200 basis points effective 6 April

- 100 basis point interest rate reduction for small business cash-based loans

- Access to business finance counselling

9. Seek Government Assistance

The government has already rolled out various initiatives to help those in financial difficulty – and it says it will announce more in the near future. So far, it has created a stimulus package for more than 6 million Australians who currently rely on Centrelink benefits, providing them a $750 payment, which will hit their bank accounts from March 31.

Within the last few days, a Coronavirus Supplement was also revealed. As an additional top-up payment for people on welfare, this Coronavirus Supplement provides an extra $550 a fortnight ($275 a week) to those receiving the JobSeeker Payment (previously Newstart), effectively doubling the amount recipients receive.

This Coronavirus Supplement goes to anyone receiving:

- JobSeeker Payment (formerly known as the Newstart Allowance)

- Sickness Allowance

- Youth Allowance for jobseekers

- Parenting Payment Partnered

- Parenting Payment Single

- Partner Allowance

- Farm Household Allowance

Payments will begin on April 27 and will be available for at least six months.

What about small business owners, sole traders, and casual workers? For those who find themselves earning less than $1,075 a fortnight, they may also be eligible for this Coronavirus Supplement. The government has waived the assets tests and the waiting period to make the supplement easier to access, but income testing will still apply.

How do you claim the Coronavirus Supplement? If you’re already receiving one of the welfare payments listed above, you won’t have to do anything. The supplement will be paid to you automatically each fortnight. If you’re not currently receiving welfare, you’ll need to apply using your Centrelink account via myGov, or by contacting Services Australia.

It’s also worth noting that the Australian Taxation Office (ATO) has announced measures to support businesses affected by the coronavirus, including deferring selected payments by up to four months. Again, contacting the ATO directly to discuss your case will let you know exactly where you stand.

What’s Your Next Step?

From cutting back to getting creative, there are many ways you can work on improving your financial health as we move into an even more uncertain future. In terms of credit cards, try to use this time to learn how to better use them, so you can add your credit card to your financial toolbox, helping your situation rather than hindering it.

Check out our sister site, Credit Card EDU to find out all you need to know about finding, comparing and using credit cards in seven, free online courses. When you’re ready to make that knowledge work for you, CreditCard.com.au can help you compare your options, as you find the card that will best work for you as your financial needs change over time.

Disclaimer: The information contained within this post is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Sources

1. https://www.westmonroepartners.com/Insights/White-Papers/Relationship-with-Subscription-Services

2. Photo source: Shutterstock

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.