Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

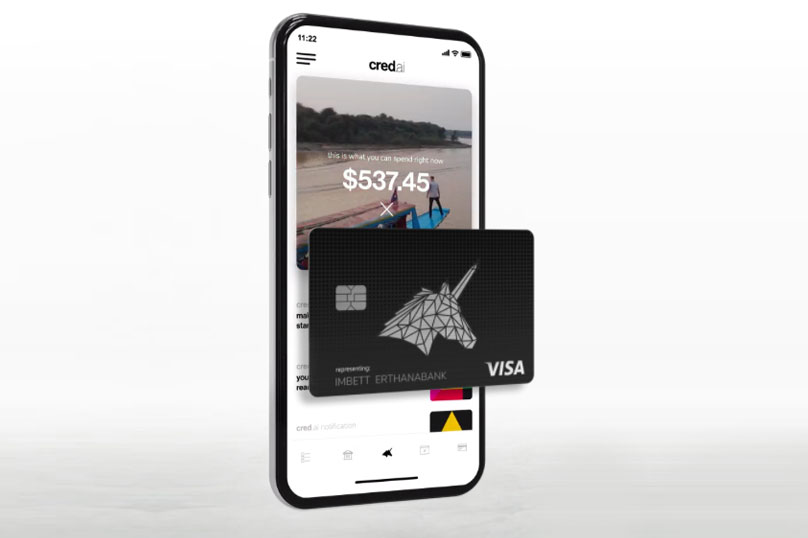

At the core of cred.ai’s offering is the Unicorn Card Visa credit card, which, when used in conjunction with an FDIC insured deposit account and the cred.ai mobile app, is designed to “give users first-of-their-kind controls, convenience, and automatic credit score optimisation”. Sounds pretty neat. So how does it work – and what exactly does it offer?

According to the company’s site,

“cred.ai is a high-tech and premium everyday card spending experience, 100% mobile with a free metal card. With the cred.ai guarantee you never pay fees or interest, never overspend, build credit automatically, and spend your paycheck early, with cutting edge tech you can’t get anywhere else.”

Before we dive in: cred ai is not available in Australia yet. But since it’s an interesting product that might hit our shores one day, let’s start unpacking how cred ai works.

Photo credit: cred.ai.

Want to compare cards like cred.ai?

Who Is cred.ai?

Even living in Australia, many of us have heard of the big banks that call the US home. JP Morgan-Chase, Bank of America, Wells Fargo. What we’ve not heard of, however, is cred.ai. So, where did this group of self-confessed oddballs come from?

Along with David Adelman, CEO Ry Brown founded cred.ai three years ago, drawing together a team of hackers, artists, scientists, and a couple of “recovering bankers”, who just so happen to be the founders of ING Direct.

Knowing that the banking industry was notoriously difficult to innovate in, Adelman and Brown wanted to push the boundaries to create something that was new and innovative. “Banking is so regulated, so antiquated, so daunting, it’s understandable why consumer card products have barely changed over the past decade,” Brown says.

But it seems cred.ai was up to the challenge. “Our outsider perspective has been one of our greatest assets. We’re not imprinted with traditional concepts of what’s possible or expected, so we get to believe we can tackle any idea we dream up, as long as we have enough coffee.”

How Does It Work?

Aside from Apple Card, released last year, there has been very little innovation in the credit card industry in recent years. So instead of seeking to follow what already existed there, cred.ai’s founders looked to financial technology companies such as PayPal and Venmo for inspiration.

“We realised early on, that if you want to build something that changes people’s lives, you need to actually build,” cred.ai chief banking officer Lauren Dussault says. “The reason every bank and fintech card offers such sparse, identical features is because they are basically white-labelling the same stock platforms with a different logo.”

Well then, how does cred.ai’s offering work? To get started, you sign up for cred.ai’s credit card – the Unicorn Card Visa – issued by WSFS Bank. From there, you agree to let the company’s AI manage your spending. As a result, the company promises you will never pay fees or interest, and it will automatically help you build your credit score.

Photo credit: cred.ai.

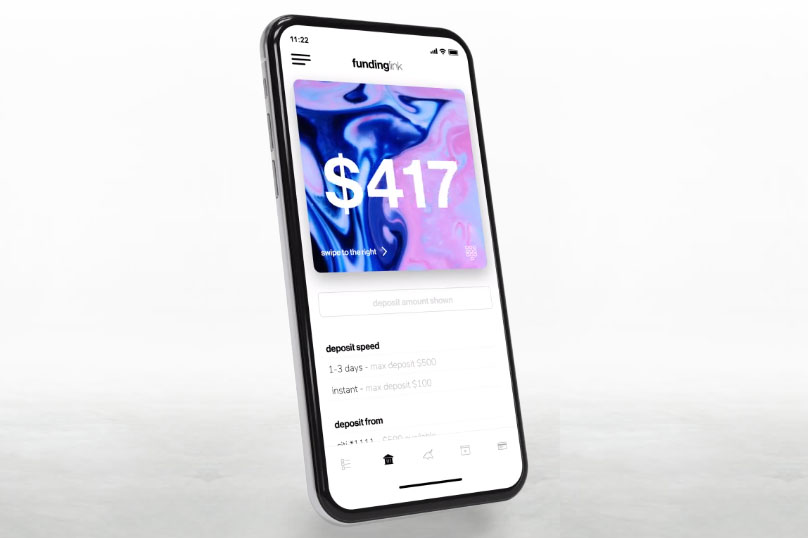

Like Apple Card, the Unicorn Card is metal, which in itself feels pretty nice. But, what’s on offer here goes way beyond looks. What’s most impressive about the card is its companion app, which basically allows you access to the card’s many futuristic features.

Opening the app, you see one big number. This is the cash you have available to spend. It’s not all of your money, or all of your available credit. Instead, it’s the money that, after taking into account your regular upcoming expenses, the company’s AI believes you can safely part with. So, even if you don’t have a head for budgeting, your credit card does.

As you use your card day to day, the card’s AI will automatically pay off your purchases from your bank account. This doesn’t happen instantly, or at the end of the month. Instead, it works out when it’s best to pay down your spending, taking into account credit utilisation, to help you build your credit score over time.

So, as long as you follow the rules, cred.ai promises you’ll never pay interest or late fees on your credit card. It even goes one step further, saying that if it calculates your available spending incorrectly, and you spend more than you should, it will cover the cost of that overspend.

Of course, this does lead to the AI being somewhat conservative in its estimations. According to Brown, it acts like “an overbearing parent”.

“If it sees you getting in trouble and spending more than you can, it will stop that transaction,” Brown says. “The automation prevents you from getting into one of those situations where you’d be in trouble.”

You may choose to turn off these AI limiters in the app, however, if you do, you will have to cover any interest that accrues on your spending at a rate of 17.76% p.a.

Photo credit: cred.ai.

What About Features?

Aside from credit optimisation then, what other features are on offer?

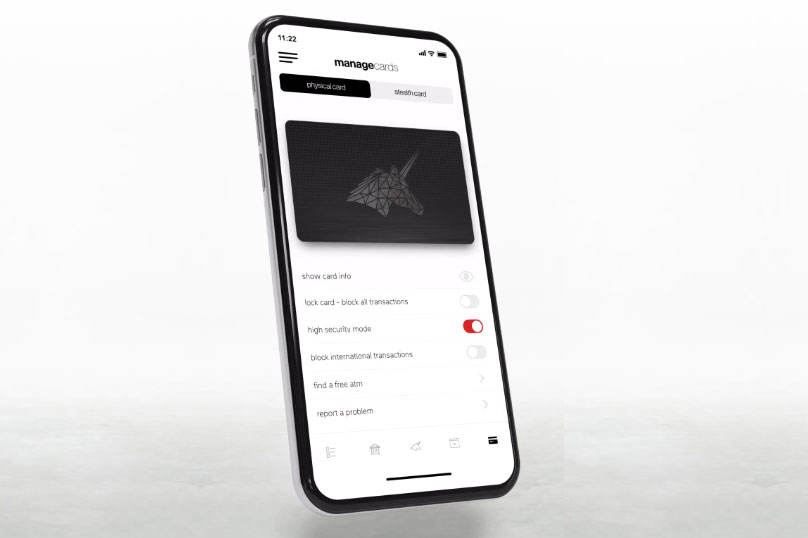

Stealth Cards

With this feature, you can take advantage of a self-destructing virtual card whenever you need one. Designed to be used for risky transactions, these stealth cards allow you to create a shadow account with a completely different set of identification numbers, which can be used, then automatically deleted. This could come in useful when you’re buying something online from a merchant you don’t quite trust, or even when you sign up to a trial service and want to avoid getting auto-billed when the trial period ends.

Flux Capacitor

Named with Marty McFly in mind, this feature essentially allows you to see into the future so you can spend – or stop spending – accordingly. Using the feature, you will see future transactions, such as bills that will need to be paid, or a paycheque that is yet to clear. “Theoretically, a bank would be capable of knowing on Wednesday that an electric company will charge you Friday,” Brown says. “And they let you spend the money and over-withdraw, and your lights are off. We don’t.”

Friend & Foe

With this feature, you can trust or restrict transactions with each individual merchant. This could come in handy if you have cancelled with your phone or internet provider, but they keep taking payments. While this feature is possible on most credit cards, it typically involves a long phone call rather than a tap on an app.

Check Please

Using this feature, you can authorise a transaction in advance to avoid a potential card decline, eliminating the embarrassment that usually goes along with that.

Photo credit: cred.ai.

High Security Mode

This security feature allows you to generate secure finite authorisation windows, allowing transactions to only be approved within that given timeframe.

Boring But True

Features cred.ai terms “boring but true” include 24/7 phone support “answered by humans”, access to more than 55,000 free ATMs, instant deposits, mobile cheque capture, payroll and other direct deposits two days early, and an on-boarding process that allows users to start spending within minutes of applying.

Some things to note here include the fact that using a credit card at an ATM to make a withdrawal is defined as a cash advance, which typically comes with fees and a higher rate of interest. However, according to the cred.ai site, “you will not pay any interest on those cash advances for as long as you have a valid cred.ai guarantee”.

As for accessing direct deposits two days early, this will depend on the timing and schedule of when the payer submits the deposit. The cred.ai site says, “We generally will allow you to access the spending power of those deposits on the day the deposit file is received, which could be up to two days prior to the scheduled payment date”.

In terms of new features, cred.ai says it is constantly updating and releasing features, allowing users access to the best in new technology – just as soon as they perfect it.

What About Rewards?

Over in the US, as in Australia, credit card rewards are big business. So, will cred.ai offer users the opportunity to earn rewards?

“Millennials don’t care about meaningless points and lounge access hiding amongst hundreds in fees”, cred.ai investor Tim Armstrong, Founder of the DTX Company and former CEO of AOL, Oath, and President of Google America says. “They care about becoming financially stronger, technology and features on the cutting edge, and companies with values they align with.”

Catering to the Millennial market is key for cred.ai. So, while there are plans in the pipeline to offer ongoing credit card cashback and rewards opportunities, these will not be aimed at points aficionados.

“Our users know that traditional cashback is a karma trap,” Brown says. “For an average user, the actual cashback earned winds up being very small, and gets outweighed by fees and interest. But the real issue is that those flashy rewards are supported and subsidised via the suffering of that bank’s lower income customers. It’s wealth redistribution in the wrong direction.”

How Does cred.ai Benefit?

Given that very moral stance – and the fact that the company says users will pay no fees or interest – you may be wondering how cred.ai plans to make any money from its offering.

Like all credit card companies, cred.ai takes a tiny piece of every transaction users make, billed to the merchant, which in the case of the Unicorn Card comes from Visa. In the US, Visa’s current rate ranges from 1.51% to 2.4%, plus $0.10, per transaction. However, in the future, the company plans to expand its offering to include big ticket items, like mortgages.

It also has plans to make money from the banking technology and compliance foundation it has built and developed. Its platform includes full compliance management, and was built modularly so that it can also be licensed to provide “bank-in-a-box” operations for small banks and brands.

“When we built ING Direct, our goal was to leverage technology to operate with 10% of the resources a traditional bank would use,” said Jim Kelly, chairman and co-founder of cred.ai, and founding COO of ING Direct. “With what we’ve built at cred.ai, I think we get that down to 1%.”

This, of course, makes it sellable.

“We don’t view infrastructure as merely a means to an end,” cred.ai Co-Founder and COO Todd Sandler says. “We see it as another opportunity to build a phenomenal product, where we ourselves are the first customer. Operating like that allows us to iterate our consumer product faster, and derive value directly from the technology itself.”

The Future For cred.ai

As of last week, US users can apply to be part of cred.ai’s beta program. On using the card, these beta testers will be given the opportunity to share their view on how advanced financial technology would impact their life goals. Of the users that share their stories, some will be selected to receive US$10,000 from cred.ai to help them reach those goals.

And looking to the future, as cred.ai moves on from beta?

“cred.ai will serve different purposes to different users,” Brown says. “For some it will be their solution to building credit without fear. Early adopters will see it as their gateway to the most advanced features. Stealth Card alone will be the reason many people sign up. Some will be drawn to our progressive beliefs, and others might just want a cool, free metal card. Regardless of the motivation, the fact that the product can be top of wallet for both a college student or a wealthy NBA superstar, says a lot about our mission to build a premium product for all people.”

In terms of product expansion, Brown says, “Right now we’re building products that help empower people financially, but next we could throw in education, health care, insurance, who knows. Whatever it is, we’ll dream it, build it, and then give it away for free.”

And Here In Australia?

Just like Apple Card, cred.ai’s offering is not available here in Australia. However, there is hope that the innovation found within these two cards could eventually trickle down to Aussie users. While it would certainly be nice to see some of cred.ai’s features available here, what we may see first is the expansion of virtual cards within the personal credit card market.

Virtual credit cards are currently on offer to businesses via companies such as DiviPay and Airwallex. Meanwhile, some debit card users at Westpac and P&N Bank can take advantage of virtual card options when they don’t want to use plastic. Virtual credit cards, though, are yet to break the personal credit card market.

What is a virtual card exactly? A virtual card is basically any card that can be held within a virtual wallet, such as Apple Pay, Google Pay and Samsung Pay. Cardholders then use these virtual cards to pay online, or in-person using a synced device. While we may have what we think of virtual credit cards that we hold in our virtual wallets right now, these are linked to physical cards, so they always have plastic as back up.

On the other hand, some providers within the business space are offering standalone virtual cards, designed to offer additional functionality, flexibility and features to users. Like cred.ai’s Stealth Cards, these virtual cards can be disposable, self-destructing after use to provide security and peace of mind to the user.

Virtual cards also benefit users in that they can be used immediately. Unlike physical cards, which need to be mailed and activated, virtual cards can be used straight away on approval. There is also the fact that there is no physical card to lose. So, if you’re on holiday, you may lose your phone and your wallet, but you could still gain access to your card via your tablet, or your travelling companion’s phone for example.

As virtual cards are used and managed online, another benefit means control of all settings is instant. This not only gives more functionality to the user, it also gives the card provider the option to offer access to more extensive features than may be available on a physical card account.

Last but not least, virtual cards reduce strain on the environment, with no physical card to create, send, and replace every few years. Given our current pandemic status, it’s also worth pointing to the fact that virtual cards may also be more hygienic due to their contactless nature.

Virtual Credit Cards in Australia

So, can you apply for a virtual credit card here in Australia? The short answer is no, not yet. The businesses mentioned above offer virtual credit cards to business users, but there are no similar offerings within the personal card market. You may find the Freestyle Mastercard offered by MoneyMe if you were to search online, but this isn’t technically a credit card, it’s a line of credit.

As with so many things here in the Lucky Country, we will simply need to wait for the technology to find its way here. In the meantime, why not check out what’s on offer in the world of traditional plastic, with CreditCard.com.au as your guide. Stealth cards may not be an option, but there are some pretty handy features to take advantage of as you wait for more exciting extras to cross the Pacific.

Photo source: Getty images, Pexels

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Credit Card Types

Credit Card Fraud Statistics

Tips & Guides

Complete Guide to the Velocity Frequent Flyer Program

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.