Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

If you use interest-free days well and pay off your debt each month, you can avoid paying interest, forever! But if you don’t, you can wind up paying more charges than you bargained for.

What are interest-free days?

They’re the period of time when you aren’t charged interest on the money you’ve spent on your credit card. If you don’t pay the whole amount back, you’ll be charged interest (ouch) and you won’t be entitled to any interest-free days in the next period (double ouch).

How do interest-free days work?

Interest-free days run from the start of that credit card’s ‘statement period’ until the payment due date. It doesn’t start from the day you buy the item! We’ve popped an image example below to make it clearer. You’ll see the statement period and payment due date clearly outlined on your credit card statement. You can also call your bank or issuer and check the dates if you’ve recently got your card and don’t have a statement yet.

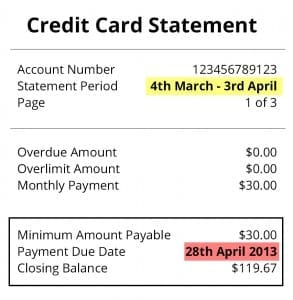

Below in example 1 (a copy of my statement period) – the statement period and payment due date are clearly highlighted.

Example 1

To avoid interest charges, any purchase made in the statement period must be paid for by April 28. (If I only pay $30 towards the closing balance, I’ll still get charged interest on the remainder. And, my interest-free days won’t be available in the next statement period.

The interest-free days for this particular statement period are the days from March 4 to April 28. Purchases made on the first day of the statement period won’t need to be paid for until April 28 – a total of 55 days.

If a purchase is made on the last day of this statement period (April 3) a payment still has to be made by April 28, so there are only 24 days left to pay before being charged interest.

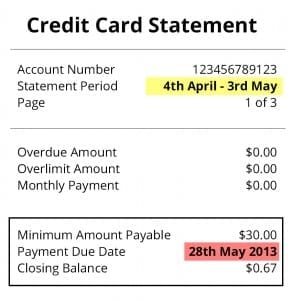

In example 1 you can see the statement period finishes on April 3, so a new statement period will begin on April 4, (example 2 below). A new payment due date is applied to the new statement period. Any purchases made from April 4 to May 3 need to be paid for by the new payment due date.

Example 2

Yes, it’s a little confusing because statement months don’t match actual months. You can see in the two examples that if you buy something on April 1 it will need to be paid for by April 28, as it falls within the first statement period. However, if you buy it on April 4, it falls in the second statement period and won’t need to be paid for until May 28.

Knowing your statement period and payment due date for that period is important if you can’t afford to pay the purchase off on your card quickly. You don’t want to accidentally pay interest or have your interest-free period revoked. Some banks or issuers may change the dates if you ask them to, which means you can organise your payments to coincide with your salary pay date.

Key points to remember about interest-free days

- The dates of the statement period, the minimum amount payable and the payment due date vary according to each account. Check these details closely on your credit card.

- If you want the maximum number of interest-free days, you should buy the item at the beginning of the statement period.

- If you make purchases and then don’t pay for them all by the due date, you’ll be charged interest on whatever balance remains.

- If you don’t pay off the whole outstanding balance, you will NOT receive any interest-free days in the new statement period. The bank won’t tell you that on your statement because it’s tucked away in the terms and conditions.

- Some credit cards offer 55 interest-free days, some 44 interest-free days and some no interest-free days at all. Check these details when you’re comparing to make sure you know what you’re getting.

Photo source: Shutterstock

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Credit Card Types

Credit Card Fraud Statistics

Tips & Guides

Complete Guide to the Velocity Frequent Flyer Program

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

J-J

16 January 2022Pauline

17 January 2022