Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Credit scores can be confusing. It’s hard to know what banks will think of your score and whether they’ll approve you for a credit card or home loan. But, you can check your score for free, and build it up quickly to boost your chances of success.

Credit scores are a big topic, and I’ll try to cover all bases without getting bogged down in the details. Let’s start with what lenders are looking for in your credit history, then tips for increasing your core.

Most banks require a score of 622+.

Credit scores are a quick way for lenders to see whether you’re a safe or risky financial candidate. Your score is checked for a credit card, car loan, personal loan, a phone contract, applying for a rental property or arranging a hire purchase agreement. One of the largest and most important loans you’ll be assessed for is a home loan, and your score affects more than just borrowing power.

“If you’re buying your first home, a strong credit score can make all the difference. It not only improves your chances of getting approved but can also fast-track the process and secure better interest rates. That could mean saving thousands over the life of your loan.”

– Jonathan Lui, Founder/CEO of Soho.com.au

If you have a higher credit score, this shows you’ve acted responsibly with credit up until now. It’s a green flag for lenders, who’ll go on to check other details like your income, expenses and other debts. While Aussie credit card providers don’t state exactly what score they require, most would say you need a Good, Very Good or Excellent credit score to be eligible. Here’s how the scores break down:

Average, Good, Very Good and Excellent scores by major credit reporters

| Equifax | ||||

|---|---|---|---|---|

| Below Average | Average | Good | Very Good | Excellent |

| 0-505 | 506-665 | 666-755 | 756-840 | 841-1,200 |

| Experian | ||||

|---|---|---|---|---|

| Below Average | Fair | Good | Very Good | Excellent |

| 0-549 | 550-624 | 625-699 | 700-799 | 800-1,000 |

| illion | |||||

|---|---|---|---|---|---|

| Zero Score | A Low Score | Room for Improvement | Good | Great | Excellent |

| 0 | 1-299 | 300-499 | 500-699 | 700-799 | 800-1,000 |

What factors affect your credit score?

Whether you want to maintain a high credit score or build your credit score from the ground up, you need to know what factors affect your credit, both positively and negatively. As you can see from the above tables, each of the three main credit reporting agencies in Australia – Equifax, Experian and illion – have their own credit scoring system, as well as their own way to score consumers. So, how does that work?

Each credit reporting agency collects data about you as a consumer to allow them to build your credit report. Using algorithms to weight that information, they create your credit score, which will change over time depending on how you interact with credit. In essence, your credit score is a numerical representation of the information contained in your credit report at any given time. Potential credit providers can then use that score to assess your creditworthiness.

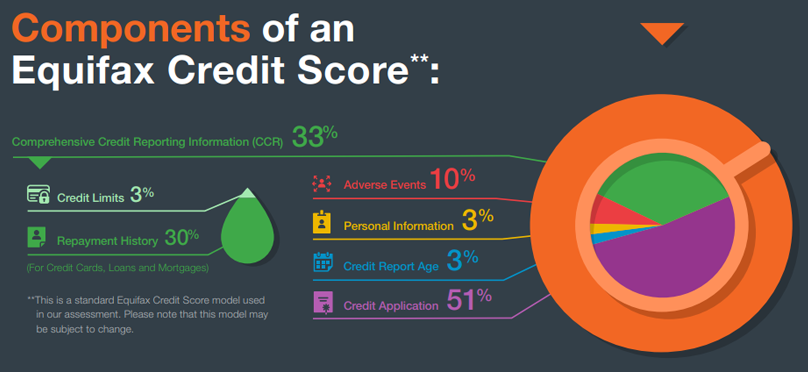

Well then, what factors affect your credit score? Let’s take a look at what Equifax takes into consideration in order to determine your credit score.

- Type of Credit Provider. There are different levels of risk involved in approaching different types of credit provider, so where you’ve applied for credit will be taken into account.

- Type of Credit. Different types of credit also come with different levels of risk, so whether you’ve applied for a home loan or a payday loan will be significant.

- Credit Amount. The credit limit or size of the loan you’ve requested will also be assessed.

- Number of Credit Applications. Each time you apply for credit, a credit enquiry is recorded on your credit report.

- Pattern of Credit Applications. Using this pattern of credit applications, you will be assessed for potential risk. For example, making lots of applications over a short space of time can negatively affect your credit score.

- Age of Credit Report. With an older credit report, it’s easier to judge you as a consumer. If you are new to credit, you are an unknown commodity, making you higher risk.

- Personal Details. Details, such as your age, length of employment, and time at your current address, all go towards assessing potential risk.

- Defaults. Overdue debts, serious credit infringements and clearouts will likely have a negative effect on your credit score, while a lack of them may positively affect your score.

- Court Writs and Default Judgements. Again, having these will likely reflect badly on you, lowering your credit score, while a lack of them should reflect positively.

source: equifax

How to improve your credit score

Time to start building your credit score? Let’s get into it.

Step 1. Find out your credit score

You can request a copy of your credit report from any of the three main credit reporting agencies, or an easier way to is to look for free credit checkers like Finder.com.au. You may need to sign up and provide some form of identification. Some may charge a fee, but there are enough free services that you should be able to avoid paying anything.

Before signing up, be aware of what you are permitting those providers to do with your data, especially when dealing with those who don’t charge a fee. It’s also a good idea to find out which credit reporting agency they take your info from.

Step 2. Correct any errors

Your credit report contains a lot of information about you and your financial status. If you want potential credit providers to see you in the best light, it’s a good idea to make sure all the information they see is actually correct.

| TIP: When you apply for credit, you don’t know which credit reporting agency the provider will use to check your credit score. Before you apply – or before you start your credit improvement journey – check your credit report with each of the three credit reporting agencies to ensure the information held within each one is present and correct. |

- If you find an error in your credit report, first report it to the credit reporting agency so they can investigate the matter. If the error is confirmed, it will be corrected within your credit report and updated free of charge.

- If their investigation concludes that there is no error, you can then talk to the credit provider that reported the error. You may need to supply evidence that proves the error is incorrect. However, they must also supply you with evidence supporting their claim.

- If the dispute is still not resolved, you have the option to raise the issue with the relevant ombudsman.

- From there, your last port of call would be the Office of the Australian Information Commissioner (OAIC). Bear in mind, you must have attempted the previous three steps before the OIAC will hear your complaint.

Step 3. Make Positive Changes

Aside from correcting any errors on your credit report, the only way to increase your credit score is by making positive changes in the way you deal with credit. Fortunately, with Australia’s system of comprehensive credit reporting, it’s not just bad behaviour that affects your credit score. Your good deeds will also come into play.

- Pay Down Your Debts: By paying down your debts, you reduce your risk as a potential borrower. This is especially true for credit card debts, so work on paying down your balances, reducing your credit limits, and closing cards you don’t need.

- Pay On Time: Always make your repayments on time. Even one missed payment can significantly affect your credit score. However, a long history of making each payment by the due date can go a long way towards increasing your credit score.

- Avoid New Applications: Every time you apply for credit, that application is recorded on your credit report. New credit enquiries – and taking on more debt – can affect your credit score, so try to hold back on new applications if you can.

- Create A Budget: Try to create a budget that cuts out unnecessary spending, which then allows you to pay down debts while creating a buffer fund. This fund could prevent you from having to apply for credit in the future, while also giving you some peace of mind.

- Update Your Details: If you move house, update your contact details, or change jobs, update all relevant parties, including your lenders. Not only is it important your details match up when you apply for credit, you also need to be able to receive bills in order to pay them on time.

Let’s say “Emma” wants to apply for her first credit card.In this scenario, 20-year-old Emma has never applied for any form of credit, apart from a phone contract. She applies for a basic credit card with a low rate, low fee and low credit limit. She meets the minimum income requirements, and having been a good customer with the bank her entire life, she is approved for the card. Knowing that her credit score is low and the information held within her credit report is limited, Emma uses her credit card to build her credit score over time. She uses the card regularly, but makes sure to pay it down to zero every week. She never misses a repayment, and never goes over her credit limit. Within two years, Emma’s credit score has increased significantly, allowing her to apply for a car loan. After assessing her credit score and credit report, the car loan provider approves Emma’s application, and she then uses that loan to build her credit score even further. |

Step 4. Monitor Your Progress

How long it takes for you to see improvement will depend on the state of your credit score when you start. The lower your score is, the longer it will take to improve. However, if your credit score is around average to start, you should expect to see improvement in 12-18 months. Keeping a close eye on your credit score can allow you to see it build over time, giving you motivation to keep at it.

It’s also worth remembering that the negative information held within your credit report will drop off over time, helping to increase your credit score as it does. Repayment history drops off after two years, while defaults, clearouts, writs, summons and court judgements are removed after five years. Serious credit infringements such as bankruptcy remain on your credit report for seven years.

| TIP: Monitoring your credit report allows you to do more than just check your credit score. By checking your credit report regularly, you can keep an eye out for fraudulent activity and report it as soon as it happens. In doing this, you could limit the impact fraud could have on your credit score, making it easier to come back from. |

Disclaimer: The information contained within this post is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Photo source: Pexels

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Kate

6 October 2021Roland

6 October 2021Stan

11 May 2021Roland

12 May 2021Lee Cheng

22 December 2020Roland

22 December 2020