Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

We’ve all seen the ads. Need money quick? Just grab a payday loan. You can borrow hundreds – or even thousands – to tide you over, with cash in your account within the hour.

Sounds too good to be true, right? That’s because it usually is. While payday lenders make a big deal about how easy it is to get approved – even for those borrowers who have “shaky” credit – you have to dig a lot deeper to find out how much the loan will actually cost.

As it stands, lenders don’t need a credit licence – and as such, are exempt from responsible lending obligations – as long as they are providing “short-term credit” on loans up to 62 days, with fees and charges no more than 5% of the amount loaned, and an annual interest rate no higher than 24%.

However, some of the more unscrupulous lenders have found ways to sidestep the rules, allowing them to charge much more than they should.

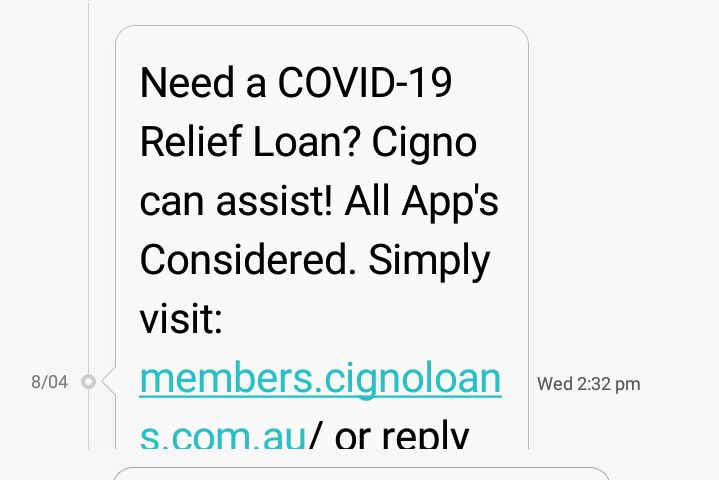

Before regulator ASIC clamped down on payday loans provider Cigno last year, one of its products was found to have additional upfront, ongoing and default fees under a separate contract that could potentially add up to 1000% of the original loan amount.

Troubling Times

Obviously, not all lenders offering payday loans are looking to bend the rules. But, payday loans as a concept should be treated with caution no matter who provides them. As their name suggests, they are designed to provide cash to tide borrowers over until payday. But what happens then?

After paying down that loan, borrowers have less to live on until the next paycheque comes in. An all too easy solution would be to take out another payday loan, creating a cycle of debt that’s hard to get out of. Especially when you take into account the sizeable fees these loans typically come with.

Given the current economic climate, more and more Aussies are now finding themselves in trouble financially. Unemployment and underemployment is on the rise, while in Victoria, countless workers are unable to earn a living due to the Stage 4 lockdown currently in place.

Throughout Australia, September will be a tough month for many, with JobKeeper payments dropping and home loan repayment holidays coming to an end. For those who chose to withdraw super as a means of supporting themselves, that finite source of income may also be running low.

Without any other option, those who are struggling may look to payday loans as a short-term solution. The only trouble is, that short-term solution may just turn into a long-term problem.

A Spiral of Debt

Say you take out a payday loan to cover some essentials. It’s only a small amount, so you know you can pay it back when your next paycheque comes in. The only trouble is, another unexpected expense pops up and you have to use your paycheque to cover that.

Now you can’t pay off your loan, so your lender adds on a default fee, plus an ongoing fee for good measure. You know you won’t have enough to cover those costs plus everyday living, so you take out another payday loan. It’s easy, and you know it will help you cover your electricity bill, which is due next week.

You now have two payday loans on the go. With the various fees and charges involved, you know you will repay a lot more than you initially borrowed. But can you afford it? With your paycheque eaten up by those two loans, what will you live off until your next paycheque clears?

This is the spiral of debt payday loans users can find themselves in. It’s also what makes payday loans such a profitable business for providers. Once you’re in, you’re in.

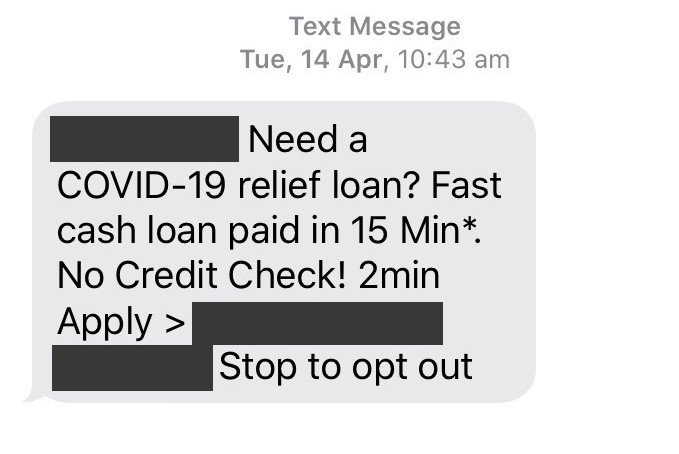

And if you do manage to get out, some providers are all too eager to draw you back in with offers of further credit. There have been a number of reports in the media of previous payday loans users being contacted by providers, offering them further loan ‘assistance’, sometimes two or three times a day.

A text message from Last Minute Loan offering a “COVID-19 relief loan”.(Supplied)

Source: https://www.abc.net.au/news/2020-04-26/coronavirus-financial-crisis-payday-emergency-loans-rent-bills/12118624

In an interview with the ABC, Consumer Action Law Centre’s director of policy and campaigns Katherine Temple stated her concerns regarding payday loans and the trouble borrowers can find themselves in when they get in over their head.

|

“As we attempt to recover from the COVID-19 crisis, it is incredibly important that people are protected from predatory lending practices,” she said. “We are concerned, with payday lending in particular, about the cycle of debt that people can find themselves in.”

“It’s not unusual for us to see people who have five, 10, 15 of these loans and, essentially, people get caught in a trap where they take out one loan to pay off the other loan. The debt spiral people often find themselves in when they take out these kinds of loans is difficult to escape.” |

A message from Cigno offering COVID-19 relief loans.(Supplied: Indigenous Consumer Assistance Network)

Source: https://www.abc.net.au/news/2020-05-21/concerns-over-payday-lenders-offering-coronavirus-relief-loans/12272332

Finding Loopholes

One of the main issues critics of payday loans have is the lack of regulation in place, which allows payday loans providers to work around what rules there are, and charge much more than they should in fees and other charges.

In the interview, Temple accuses short-term lenders of structuring their businesses to avoid regulation under national credit laws. “This means people using these products miss out on important consumer protections like affordability checks, financial hardship assistance and proper dispute resolution processes,” she says.

“They [short-term lenders] spend a lot of time and energy finding loopholes in the law so that they can hand out loans to people who are, essentially, in financial hardship and can find themselves in quite desperate situations.”

Likening her organisation’s struggle to playing the game whack-a-mole, Temple said, “As soon as you close one loophole or one problematic business practice, they seem to be able to find another loophole.” Temple stated CALC is currently pushing the government to introduce an anti-avoidance provision to address some of that behaviour.

Payday Lenders Hit Back

So what do providers of the much-maligned payday loans have to say for themselves? MyPayNow – a lender targeted by CALC – said it rejected any suggestion it lends to people in financial hardship, saying it only lends to those with evidence of regular employment income, denying applications from people whose income is from Centrelink or whose bank statements indicate “gambling, excessive borrowing or any direct reversals or overdrafts”.

MyPayNow general manager Nic Bennetts said, “We believe our product helps customers ‘out of a jam’ and gives them the option to avoid putting things on credit cards, or going to pawnbrokers which, in the end, will cost them more if the cost is measured in dollars and not artificially converted to an interest rate over time.”

Bennetts also pointed out that, while MyPayNow advertises on radio, digital and billboards, it does not market directly to former customers, unlike some other lenders.

ASIC Regulation

As in any sector, there are those in the world of payday loans that stick to the rules – and those that skirt them. So, what is ASIC doing to prevent the so-called predatory lending practices of payday loans providers that are perhaps not behaving so honourably?

Following last year’s royal commission on banking, ASIC was extended the power to ban or change financial products where there was a risk of causing harm to consumers. Wielding those powers for the first time, the regulator set its sights on controversial online payday lender Cigno.

CignoTo understand why Cigno was targeted, let’s take a look at how the company operates. Looking at its site, you can see Cigno offers borrowers access to a number of different types of loan, from bad credit loans and no credit loans, to Centrelink loans, loans for the unemployed and emergency loans. But, while these loans are all labelled differently, they all seem to be similar in nature, in that they act in the same way as payday loans, providing short-term credit to those who need it. Like most payday loans providers, Cigno promises fast access to cash with a “high approval rate” and “all applications considered”. What the company also states is that, “With us there is nothing hidden, no surprises, no catches, no worries!” If you were to take a look at its cost breakdown however, that statement could be disputed. Cigno notes it is not a lender, but “acts as an agent to help” consumers obtain a loan from lenders. With that in mind, the costs associated with applying for a loan through Cigno can be broken down into two parts:

Cigno provides the following example of how those charges could work. If you were to take out a loan of $300, you would pay Cigno’s fees, which could range between $129.90 and $291.55, “depending on the factors of that advance”. Cigno also states, the “fees charged are for the optional use of Cigno’s service and are independent of the principal and interest repayments due to the lender”. On its site, Cigno also notes a Change of Payment Fee of $22, and a Dishonour Fee of $79. So, how can Cigno charge fees such as this when there are regulations in place that cap the amount lenders can charge on short-term credit? As an ‘agent’, rather than a lender, Cigno has structured its business so that it is not bound the same rules as lenders, meaning it can charge much higher ‘service’ fees. |

ASIC’s Big Move

Believing borrowers were paying more than they should to access loans through Cigno, ASIC decided to build a case against the company to ban products that used a model of what it described as “predatory lending”. In doing this, the regulator presented the following example.

On obtaining short-term credit through Cigno for $120, a customer paid a $90 supply fee and $5.95 in weekly account keeping fees to Cigno, plus a credit fee of $6 to the lender. The total amount to be repaid was $263.60, but, when the consumer defaulted, she was charged various dishonour fees and ongoing weekly account-keeping fees.

With the fee structure in place, the customer was liable to repay $1,189 on the original $120 loan, equivalent to 990% more than what was borrowed.

The main reason Cigno and its associated businesses – Gold-Silver Standard Finance and BHF Solutions – were able to do this was because of the separation of their companies. With this separation, the lender offered loans that kept within the limits placed on fees and interest, while Cigno, as an ‘agent’, could charge much more for the services it provided.

ASIC won its case, and in doing so created an intervention order that “ensures that short-term credit providers and their associates do not structure their businesses in a manner which allows them to charge fees which exceed the prescribed limits for regulated credit”.

The ban took effect on 14 September 2019, and will remain in effect for 18 months from that date, unless it’s extended or made permanent. The Federal Court has so far dismissed one legal attempt by Cigno to overturn the ASIC intervention, and Cigno has appealed again.

Moving Forward

Cigno and its associates are now facing another case being drawn up by ASIC, this time for the provision of “continuing credit”, in which multiple advances are contemplated. In its paper, ASIC states these continuing credit contracts are issued in a way that do not give borrowers access to external dispute resolution schemes, or consumer protections under the National Credit Act.

The paper cited an example of one borrower using Cigno’s services to access a $250 loan, and was charged almost $215 in upfront fees, $80 in ongoing account-keeping fees and $685 in default fees. As of December last year, the borrower had only made $309 in repayments and still owed Cigno and BHF Solutions more than $900.

Hitting back at ASIC, Cigno created a page on its website urging its customers to complain to the regulator and urge it to stop the ban, thereby saving Cigno from being forced to charge them less.

“The reality is that ASIC, the government regulator, have formed their view based on a very small percentage of our customers,” Cigno CEO and director Mark Swanepoel wrote in a submission to ASIC. “To meet their agenda, they have in most cases used clients that have paid back nothing, been charged for defaults and are looking for an easy way to get something for nothing.”

“We are fighting a large group of hypocrites – the leeches of society who steal more and more freedom and choices from everyday people behind the veil of good intentions.”

Noting 70% of the company’s active database were returning clients, Swanepoel said, “We do not hide away from what we charge for the service we provide and are extremely proud to have helped the many thousands of people we have”.

The National Credit Providers Association Has Its Say

However, it’s not just ASIC that has something to say on the matter of Cigno. The National Credit Providers Association put in its two cents in a statement provided to the Nine Network.

Firstly though, what is the National Credit Providers Association? The NCPA is the peak body for ASIC Licensed Credit Providers who provide small and medium loans and operate under the National Consumer Credit Protection (NCCP) Act. Its members provide access to credit for the 3 million “financially excluded” Australians who are unable or choose not to get credit from a bank.

Cigno is not an NCPA member, and to the best of our knowledge does not provide access to SACC loans. The Australian Securities Investment Commission has acted against Cigno using new product intervention powers under legislation introduced into Federal Parliament last year. The NCPA fully supports this legislation.

“I understand ASIC took action in the Federal Court and successfully prevented Cigno from continuing to provide a product that does not comply with the NCCP Act,” NCPA chairman Michael Rudd said. “The NCPA welcomes ASIC’s continued efforts to prevent the provision of financial products from unlicensed lenders.”

Following on from this, the statement added:

“What is not working is the fact that the current laws and consumer protections do not cover lenders such as Cigno or other providers who offer continuing credit loan contracts. These lenders are often referred to as payday lenders. However, they operate outside the legislation governing SACC providers and currently there are no moves to bring them within this protective legislative safety net.”

And on the subject of fees:

“Legislators should ban the use of third-party service agreements which allow unscrupulous companies to get away with charging exorbitant fees.”

Creating a Solution

But while ASIC continues its fight, many Aussies fall further into debt and are drawn to products such as those in question. What’s the solution?

According to Financial Counselling Australia’s chief executive Fiona Guthrie, further regulation is required within the industry. One suggestion she made in a recent interview was to restrict the amount a person could borrow on a payday loan to 10% of their net income.

Pointing to the previously mentioned MyPayNow, which currently offers loans of up to 25% of a customer’s regular employment income, Guthrie said there was too much discretion in granting loans for lenders exempt from responsible lending protections.

“You need additional safeguards and protections when you’re dealing with a product that has got so much room for danger,” she said. “It’s left very much to the provider to make an assessment and they can come down on the side of, ‘let’s give people as much debt as possible’.”

And for those borrowers who have already suffered at the hands of unscrupulous lenders? In an interview last year, Consumer Action Law Centre chief executive Gerard Brody said ASIC should consider compensation for affected consumers.

“Since 2015, Consumer Action’s legal practice has provided legal advice in relation to Cigno 117 times, including 37 times since the start of the year,” he said. “Many of the people contacting us, including financial counsellors supporting vulnerable clients, complain about unaffordable and exploitative loans facilitated by Cigno.”

Finding an Alternative

For those who are struggling financially, seeking professional help is an avenue well worth exploring. On the government’s MoneySmart site, it provides helpful information regarding financially counselling, including what it offers, how it works, and how to find a financial counsellor if you’re feeling overwhelmed.

And for those who are simply looking for an alternative to high cost credit options such as payday loans? If you know where you stand financially, and just want to make a more informed choice when accessing credit, you should consider investing some time in educating yourself. Which is where our sister site, Credit Card EDU, comes in.

There’s no denying credit cards can land you in just as much trouble as a payday loan. However, if you understand how credit cards work – and learn how to use them responsibly – you can use them to your advantage, while potentially accessing credit for free. Credit cards also have the added benefit of being highly regulated, which means borrowers are only provided with credit they are capable of paying back.

To find out more about the free online courses available on Credit Card EDU, visit the site today. Or to compare card options, check out CreditCard.com.au, starting with low rate or no annual fee cards if you want to keep costs down.

National Debt Helpline — 1800 007 007

The free National Debt Helpline is open from 9.30am to 4.30pm, Monday to Friday. When you call, you’ll be transferred to the service in your state.

Disclaimer: The information contained within this post is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Photo source: Shutterstock

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.