- Limited-time offer: Get 150,000 bonus Qantas Points when you spend $5000 within 90 days of approval (conditions apply).

- Qantas Points: Earn up to 1.25 points per $1 in Australia and 2 points per $1 on overseas spending.

- Travel extras: 2 Qantas First Lounge and 2 domestic Qantas Lounge (or Qantas-operated International Business lounge) invitations per year

- Discount 10% off on eligible Qantas flights for up to 2 travellers, twice a year.

- Insurances: Complimentary domestic and international travel insurance, and rental vehicle excess cover in Australia.

- Other perks: 24/7 concierge services

- Digital access: Sync your card with Apple Pay and Google Pay digital wallets.

- 20% Bonus Status Credits on eligible flights purchased on your card.

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Qantas Money Credit Cards

Qantas Money Titanium Card

Updated 3 October 2025

This is a top-tier credit card that offers a massive 150,000 bonus Qantas Points, 20% bonus Status Credits and luxury travel with Qantas First Lounge invitations.

You’ll also get complimentary travel insurance, Qantas Wine Premium Membership and other exclusive Qantas privileges and benefits.

Terms and conditions apply

Points Earn Rate (per $1 spent)

1.25 points

Capped at $12,500 per statement period (domestic)

Rewards Program

Qantas Frequent Flyer

Bonus Points

150,000 pts

Spend $5,000 within first 90 days

Pros and cons

- Earn rate drops to 0.5 points per $1 after AU$12,500 per statement period

- Additional cardholders are $100 each per year

- High annual fee of $1200

Creditcard.com.au review

Editor Review

Qantas Money Titanium Card

Overall Rating

Make no mistake, this titanium card (literally) is a high-end, top-tier product that rewards you with abundant points, massive travel features and premium lifestyle extras.

Frequent travellers will also benefit from the 20% bonus Status Credits (the only credit card with this offer), premier lounge access and big savings on worldwide travel.

Editor’s Review: What I love about the Qantas Money Titanium credit card

This card is a lot to unpack, but it’s worth it. I’ll break down the terms behind the limited-time bonus points first, then look at the other features and rewards.

Bonus Qantas points: You can earn an enormous 150,000 bonus Qantas Points when you spend $5000 on eligible purchases on your card in the first 90 days from approval. Points are credited to your account within 2 months of reaching the spending criteria.

Qantas says these purchases are not eligible for the bonus points and points per $1: Cash Advances, Balance Transfers, Special Promotions, BPAY payments, purchases of foreign currency and travellers cheques, transactions made in operating a business, payments to other Citi branded accounts, bank fees and charges such as interest and ATM charges, transactions made using Qantas Points and government related transactions. Government related transactions include transactions with government or semi government entities, or relating to services provided by or in connection with government (for example but not limited to transactions made at Australia Post, payments to the Australian Taxation Office, council rates, motor registries, tolls, parking stations and meters, fares on public transport, fines and court related costs).

How many Qantas Points can you earn?

This card rewards you differently depending on what you buy and where it’s from. You’ll earn:

- 1.25 Qantas Points for every $1 you spend in Australia up to $12,500 per statement period, then 0.5 points thereafter.

- 2 Qantas Points for every $1 you spend overseas, either online or in person.

- 2 additional Qantas Points for every $1 you spend on Qantas Products, which are: flights booked directly through the Qantas website, Contact Centres and selected travel agents, purchases of Qantas Frequent Flyer and Qantas Club memberships, joining and annual fees, and purchases from Qantas Wine and Qantas Marketplace.

There are terms and conditions for earning rewards so it’s worth reading the PDS to make sure you’re getting the maximum amount.

You can also earn extra Qantas Points (even while you sleep):

20,000 points through the Qantas Wellbeing app

You and any additional cardholders could earn up to 20,000 Qantas Points in a year by completing daily, weekly and monthly challenges. These include everyday activities like walking, swimming and sleeping, and completing car safety checks. Points are credited to your account every 2 weeks.

Shopping with big brands through My Card Offers

You can earn bonus points when you shop with top Australian retailers via the Qantas Money app. Each week you’re emailed discounts and special offers as well.

Travel features

This is where the Qantas Money Titanium shines. Here’s a rundown of the included travel perks:

20% bonus status credits: A benefit unique to this card is the 20% bonus Status Credits on eligible Qantas flights for you and all additional cardholders. You need to book and pay for the flight on your card using the Qantas website or the Qantas Money Credit Card Concierge, and it must be a Qantas operated or advertised flight.

| Additional terms: I did notice in the terms that this offer can’t be used to move you from Platinum to Platinum One Qantas Frequent Flyer membership nor can a Platinum One member use the status credits to retain the Platinum One membership status. Bonus Status Credits will also not contribute to Lifetime Status, Loyalty Bonuses, Platinum Bonus Reward, Platinum One Member additional benefits. |

Lounge passes: Every year, you’ll get up to 4 complimentary single-entry lounge passes. A pass can be transferred to a companion travelling under the same booking.

2 passes will get you into the luxurious Qantas First Lounges in Sydney, Melbourne or Los Angeles. The other 2 are for the domestic Qantas Club lounges or Qantas-operated International Business lounges (not including the Tom Bradley Terminal in LA).

10% off Qantas flights: The 10% discount is available for two bookings per year for two people on all fare classes (international and domestic) on Qantas and QantasLink flights. It applies to the base fare and not other taxes and fees. The booking has to be made through the dedicated Qantas Money Credit Card Concierge service and paid in full to get the 10% discount.

Products include Qantas gift cards, flights booked through the Qantas website, Contact Centres and selected travel agents, purchases of Qantas Frequent Flyer and Qantas Club memberships, joining and annual fees, and purchases from Qantas Marketplace.

Complimentary Qantas Wine membership: This card comes with a Qantas Wine Premium membership, which includes free delivery within Australia and a bonus 3 Qantas Points on purchases when you use your Qantas Frequent Flyer details. Qantas Wine offers wine, champagne, beer and spirits.

Travel insurance

The Qantas Money Titanium comes with a suite of travel insurances across Australia and overseas. The information here is a snapshot of the cover provided, so please check the insurance PDS to see the full list of terms and eligibility requirements.

| Type of cover | Length of cover | Inclusions |

|---|---|---|

| International travel insurance | Up to 180 days with $250 excess |

|

| Domestic travel insurance | Up to 14 days with $500 excess |

|

| Rental vehicle excess cover | Domestic and overseas trips | Up to $5,000 per covered person for overseas trip or up to $3,000 per covered person for domestic trip, with $250 excess |

| Eligibility: as an example, all travellers must meet age requirements (79 years or under), be an eligible family member, and have airfares or cruise tickets paid for with the Qantas Money Titanium card. Your trip must also start and end in Australia, and all travellers must be Australian residents. |

Other features and extras

Dedicated concierge service: Not only will your Qantas Money Credit Card Concierge take care of big tasks like booking tickets, making reservations or organising accommodation, it’s how you can get 10% off your Qantas flights. You’ll find the dedicated concierge number on the back of your card or in the Qantas Money app.

What’s not so great

This card is flush with features but that also means a lot of terms and conditions. You’ll need to check the PDS to make sure you’re getting what you expect before you make purchases, especially on discounts and status credits.

The annual fee is a big step up from a standard credit card, but that’s because it’s a top-tier card for high income earners. As always, you need to check you’ll earn more in benefits and rewards than you spend in fees.

If I had one gripe it’s that I’d have hoped to see more lounge passes available, but getting up to 4 each year is still twice as many than most credit cards offer.

Who suits the Qantas Money Titanium credit card?

The Qantas Money Titanium card is full of unique privileges and advantages that suit high-flyers and big spenders. It benefits those who fly with Qantas regularly and want to earn Qantas Points and boost their Status Credits.

It offers plenty of opportunities to save money on discounted fares, shopping and insurances, making it a good fit if you get a thrill out of maximising your funds.

User reviews

Rates and fees

Interest rates

Purchase rate 20.99% p.a.

Cash advance rate 21.99% p.a.

Interest free period on purchases up to 44 days

Credit limits

Minimum credit limit $15,000

Maximum credit limit N/A

Fees & repayments

Annual fee $1,200 p.a.

Additional cardholder fee up to 4 at $100 p.a.

Foreign transaction fee 3%

Minimum repayment 2% or $25 - whichever is greater

Cash advance fee 3% or $3 (domestic); $5 (international)

Late payment fee $30

Rewards and points

Rewards program

Rewards Program

![]() Qantas Frequent Flyer

Qantas Frequent Flyer

Bonus points 150,000 points

Annual points cap uncapped

Bonus points spend criteria Spend $5,000 within first 90 days

Earning points with this card

Qantas Rewards points 1.25 points per $1 spent

Points cap per month Capped at $12,500 per statement period (domestic)

Overseas earn rate 2 points per $1 spent

Additional features

Complimentary insurance

International Travel Insurance Yes

Flight Inconvenience Insurance No

Transit Accident Insurance No

Smartphone Screen Insurance No

Purchase Protection Insurance Yes

Extended Warranty Insurance No

Rental Vehicle Excess In Australia Insurance Yes

Extras

Travel insurance underwritten by Chubb Insurance Australia Limited

Dedicated Qantas Money Credit Card Concierge

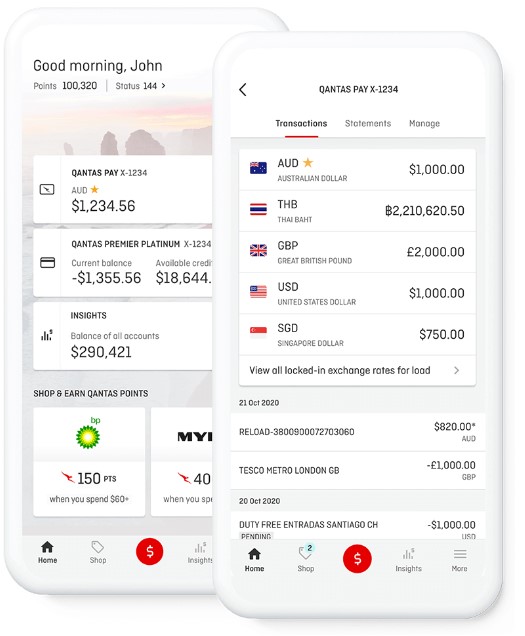

Compatibility with Qantas Money App

Complimentary Qantas Wine Premium Membership

2 additional lounge invitations each year for Qantas Club

20% bonus Status Credits on eligible flights

10% discount on eligible Qantas flights for up to two travellers twice a year

2 Qantas First Lounge invitations each year

Overview

Qantas Money Titanium Card

The Qantas Money Titanium Credit Card packed with features for an annual fee of $1,200. New cardholders can currently benefit from 150,000 bonus Qantas Points when they spend $5,000 on the card within 90 days from card approval. Get 20% bonus Status Credits on eligible flights, and 10% discount on Qantas flights twice a year.

Key features

- 150,000 Bonus Qantas Points when spending $5,000 within 90 days of approval

- 20% Bonus Status Credits on eligible flights purchased on your card

- 10% Discount on eligible Qantas flights for up to 2 travellers twice a year

- 2 Qantas First Lounge Invitations

- Compatible with Apple Pay and Google Pay

- 1.25 points on Domestic Spend (up to AU$12,500 per statement period)

- 2 Qantas Points per dollar on International Spend

- 2 Additional Qantas Points per dollar on Qantas Spend

- Annual fee of $1,200

Minimum criteria to apply for this card

-

Be over 18 years old

-

Good Credit and have not applied for multiple credit cards recently

-

Permanent Australian resident. Have an Australian mobile and residential address.

-

Minimum income of $200,000 p.a.

You have your personal details ready to complete the online application

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

IMAC Canberra

14 January 2020The Titanium offers (not) a lot but delivers even less. The 10% savings on travel can be better achieved by simply looking for sales. You also get hit with a booking fee which takes back some of the savings. $12,500 maximum monthly spend for extra FF points....so why target people who earn over $200k - there should be no maximum. The extra status credits - they frequently get them wrong or don't award them without being chased up. Concierge - based in the Philippines, frequently poor line quality, some staff very good but also often get staff who do not completely comprehend the issue and cannot fix the problem without referral elsewhere, and promised return-calls may or may-not be returned. It's metal, but not like Centurian - this is a cheap sandwich of metal and plastic and nowadays you rarely use the card beyond a tap so if you were hoping to impress (it doesn't) you will be mostly out of luck. Access to lounges - most who get this card are already high FF status and therefore don't require the passes - and unlike other cards (eg Qantas Ultimate Amex) - you cannot transfer them to anyone else so they go unused. Insurance - Titanium is $5k max on car excess. Some hire cars have a higher excess than this so you aren't actually fully covered. Q Ultimate Amex is 20k for hire car which means you never have to take out additional insurance. $1,200/year plus $100 for additional card-holder - zero back in travel (beyond the discount). Q Ultimate Amex is $450/year and you get $450 travel credit. All in all, it looked like it offered something a bit different - perhaps a card with exceptional service that was widely accepted. In the end it is simply an overpriced way to get an additional 150k points. Suggestions for improvement: Move Concierge back to Australia, Remove booking fees on flights using concierge, make points accumulation unlimited per month, give some kind of credit for travel, raise the insurance coverage for Car Rental, make the Lounge Access transferable....that would be a start

Does not recommend this cardNeville Amish

3 March 2019The bonus points are massive plus great points earning

Recommends this card