Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

For many Aussies, taking a punt is simply part of everyday life. Buying scratchies or lotto tickets, or putting a few lines on at Keno, or dropping a few dollars on the AFL Grand Final. Using a credit card to place bets has been banned since the early 2000s – and yet it’s ok to use a credit card if you’re betting online. Here’s why your credit card is losing you more than just a bad bet if you use it for gambling.

Whether you partake or not, gambling is pretty hard to ignore here in Australia. Just look at all those rows of pokies lined up at your nearest RSL. Watch as Santa promotes scratchies as a great gift idea in the lead-up to Christmas. Take in a show, indulge in a spa day, or stop in for a quick drink after work at your local mega-casino.

Then there’s Sportsbet. Bet365. Ladbrokes. Beteasy. Neds. Unibet. They’re all eager to let you know they’re ready and waiting to take your bet. Which, since COVID hit, has become something of a problem. As a nation of gamblers (the latest stats from Australian Gambling Statistics show Aussies are the world’s biggest gamblers in per capita terms), we have embraced online gambling wholeheartedly.

Financial reports from Australia’s most popular online betting companies speak for themselves. During the 2019-20 financial year, Tabcorp’s digital wagering turnover grew by 3.8% to $7.1 billion. Sportsbet’s parent company, Flutter Entertainment, reported its Australian operating profits close to $200 million in the first half of 2020, with online net revenue up 45%. Meanwhile, Ladbrokes’ parent company, GVC Holdings, recorded a 43% increase in profits over the same period. (1)

The Issue of Payment

Which leads to the issue of how we paid for all that. Lost a few bucks on a bet? Probably not too much of a problem when it happens once in a while. Losing a few bucks – or more – on a number of bets every day, and your finances will soon start to feel the strain. Which is where credit cards come in. Or rather, they shouldn’t, but they do.

In the world of gambling, the use of credit cards and cash advances within bricks and mortar venues has been banned in Australia since the early 2000s. So, if you go to a casino or down to the racetrack, if you go to the pokies lounge or the TAB, you will not be able to use your credit card to place a bet.

If you’re placing a bet online, however, covering the cost with a credit card is perfectly okay.

So, what’s the problem here? Aside from the fact that you are borrowing money to bet, there is the cost involved in this type of transaction. When card providers process gambling transactions, they treat them as cash advances. As such, they attract fees and much higher interest rates than regular transactions. These rates can push 25% p.a. and are applied from the moment the transaction is made.

Then there’s the fact that online gambling sites just make gambling so easy. They are ‘open’ all the time – and there’s always something to bet on. And, much like when you’re using plastic to pay for anything else, there is a disconnect between the transaction and the thought of eventually having to pay it off. It just doesn’t feel like you’re spending money.

The ABA Has Its Say

At the end of last year, the Australian Banking Association summed up its year-long review on the matter by saying, “Online gambling creates an environment in which people can gamble at any time, in any place, and in a ‘cashless’ way, which can distance the person gambling from the money which is being spent”.

As such, the ABA described the “issue of customers using credit products to finance problem gambling” as a “concern to ABA members”. Seeking the views of the community, the review cited YouGov survey data that found 54% of Australians believed there should be a total ban on using credit cards to place bets or gamble. Just over 80% believed there should be some form of restriction or ban, while only 7% believed there should be no restrictions at all.

“The majority of submissions and the ABA website survey responses supported a restriction or ban on the use of credits cards for gambling,” the report said. “The associated risks were considered to significantly outweigh any potential benefits for customers, especially for vulnerable populations such as individuals experiencing gambling problems.”

Within the review, the ABA looked at various solutions other countries have put in place. In North America, for example, credit card use for online gambling is prohibited under a 2006 law. Over in the UK, the UK Gambling Commission passed a ban in April last year preventing businesses from accepting credit cards when taking bets.

Despite its findings, however, the ABA stepped back from the responsibility of making proposals for change. In saying it would “not be making recommendations or suggestions regarding the restriction or banning of credit cards for gambling”, it would instead ask its member banks to “assess the consultation report and make their own decisions regarding any changes”.

MP Calls for Change

Seemingly disappointed with this outcome, Queensland MP Andrew Wallace is now calling for a crackdown within the banking industry, asking banks to step up. Saying banks have a “social responsibility” to ban credit card use in online betting, the LNP Member for Fisher suggests banks create a voluntary code of conduct to ensure punters only use their own money when placing a bet.

“You can’t use a credit card to go into a TAB and gamble on the horses or the dogs, you can’t use a credit card at a casino, and you can’t use a credit card to gamble on the pokies,” Mr Wallace said. Putting an end to credit card use in online gambling is what he calls a “no-brainer”.

“Banks have a social responsibility to step in and say: ‘We’re not going to allow this to happen any further’. If they won’t introduce a voluntary code, I’ll be recommending to my Parliamentary colleagues that we force them to do it. If they don’t act voluntarily, they don’t leave us with a lot of options.”

Financial Counselling Australia director of policy, Lauren Levin, also thinks banks should commit to a ban. Or if that fails, the government should intervene to regulate the industry. “Gambling on credit cards is a double whammy,” Ms Levin said. “First, you lose your money gambling. Then, you pay credit card interest rates often over 20%.”

“There are so many other ways to pay for gambling. Each online wagering company has about 10 payment choices, including debit cards. Stopping credit card gambling won’t break the industry, but it will help a lot of people avoid debt issues.”

Gambling Lobby Hits Back

Perhaps unsurprisingly, gambling lobby Responsible Wagering Australia, had something to say on the subject of banning credit cards within online gambling. Stating there was no reason to stop punters going into debt to gamble, chief executive of the lobby, Brent Jackson, said online gambling was “safer” than betting in a casino or at a pokie machine.

Why? Stating online gambling was already governed by strict legislation, Mr Jackson also pointed out that online gambling sites have the ability to monitor gambling behaviour in real time.

“They do keep an eye out specifically for unusual behaviour and strange behavioural patterns and activity that is not considered normal and might be risky,” Mr Jackson said. “We can take a number of interventions, aside from banning them completely. We often contact customers directly as this is happening.”

Much like the warnings you see on the side of bottles of alcohol, online betting sites warn users to gamble responsibly. In addition to that, they offer deposit limits and self-exclusion systems. The industry has also backed a federal national exclusion register, which would give problem gamblers the opportunity to ban themselves from all Australian-licensed wagering services.

Mr Jackson said it should be up to punters to decide whether they use credit cards when gambling online. “We think that consumers should have the right to choose and directly manage their betting preferences,” he said. “What we’re not seeing is any evidence of a problem out there at all. We think punters behave responsibly.”

While some may argue the truth of that statement, there are those who would point out that issues pertaining to problem gambling are often multi-dimensional – and that removing credit cards from the equation may not necessarily fix those issues.

It could also be argued that implementing a credit card ban could push gamblers who prefer using credit cards towards sites that do not have local licenses from Australian regulators.

“You Can’t Win”

However, it has been alleged that there are problems within online gambling that go far deeper. Back in 2019, an ABC investigation (2) reported accusations of a skewed system within Bet365, after former employee James Poppleton came forward with claims that the online bookie used algorithms and other tactics to encourage losing gamblers, while banning or restricting winners.

“Australians have an innate sense of fairness almost built-in, and what the bookies do, what Bet365 does is not fair,” he said. “You can’t win. Those that win are stopped. Those that lose are exploited, and then they develop cheating techniques as well.”

Poppleton alleged Bet365 assigned risk ratings to users and allowed them to bet accordingly – all while ensuring the house remained ahead. “Your data tells them how many bets you’ve placed, what sport you’ve put it on, your average bet, your total turnover and your win or loss ratio to the company,” he said.

“If you win, the algorithm kicks in and stops you from being able to bet any significant amount of money.” And if you’re losing? “As soon as you start losing, they’ll open you up to lose more and more and more, you can bet bigger and bigger amounts,” he said. “It’s the opposite of responsible gambling.”

A Sizeable Problem

So, how much of a problem has online gambling become? According to a study released recently by the Australian Gambling Research Centre (AGRC), there has been a real push towards online gambling in Australia since COVID hit. (3)

In a survey of more than 2,000 gamblers, one in three said they signed up for new betting accounts in June and July. Men aged 18 to 34 made up 79% of those new account holders, and as a result, increased their median monthly spend from $687 to $1,075. The survey also revealed that the number of participants who placed bets more than four times a week increased from 23% to 34%.

Researcher Rebecca Jenkinson pointed to isolation, boredom and betting promotions as the key reasons behind these increased numbers. “They reported being heavily exposed to ads and promotions, and that was often a motivation for them to gamble,” she said.

The study further revealed that of those surveyed, about 78% now gambled online, compared to 62% before the pandemic. “I don’t think we’ll see a decrease back to pre-COVID levels anytime soon,” she said. “This is still a real time of uncertainty for a lot of people. A lot of people have lost jobs and some of the motivations for online gambling, particularly among young men in his sample, haven’t gone away.”

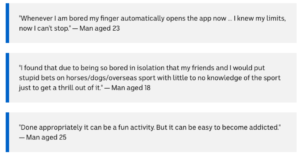

Here are some responses from survey participants.

Source: https://www.abc.net.au/news/2020-10-13/australia-online-gambling-covid-19-sportsbet-ladbrokes-tabcorp/12758084

The Risk Is More Than Just Financial

More recent research out of the UK investigated the effects of gambling more closely, finding that not only is the habit linked with addictive behaviour and financial problems, it also comes with an increased risk of death. (4)

Led by Dr Naomi Muggleton, the Oxford University study revealed that high levels of gambling are associated with a 37% increase in mortality. “High levels of gambling are associated with a likelihood of mortality that is about one-third higher, for both men and women, younger and older,” the report states.

Why? An answer could be that heavy gamblers were found to spend less on health and wellbeing. The study states that there is “a negative association between gambling and self-care, fitness activities, social activities, and spending on education and hobbies. There is also an association between gambling, social isolation and night-time wakefulness”.

In terms of financial risk, the research showed that the top 1% of gamblers surveyed spent 58% of their income, while one in ten spent 8% of their income on the habit. Highlighting the financial damage, negative lifestyle and health impacts of gambling, the study revealed how effortlessly gamblers moved from ‘social’ to high-level gambling in a matter of months.

“To me, the striking finding is the extent to which even low levels of gambling are associated with harm,” Dr Muggleton said. “For many years, there has been a focus on outcomes among the most extreme gamblers. Our work shows that financial distress, social ills, and poorer health are more prevalent among low level gamblers.”

The study pointed heavily to just how ‘sticky’ a behaviour gambling could be. “We find that, for example, three years earlier around half of the highest-spending gamblers were already gambling heavily, while only six months before, over 6.9% of these heavy gamblers were not gambling at all, highlighting the fast acceleration with which some individuals can transition into heavy gambling.”

The Banks Have Their Say

While the onus of responsibility can’t be placed squarely on the banks, banks in Australia could choose to ban credit card use within the online gambling arena to reduce potential damage for problem gamblers. However, out of the dozens of credit card providers here in Australia, there are only a handful that have taken that step so far.

American Express, Bank Australia, Bank of Queensland, Bendigo Bank, Citi, Credit Union of Australia (CUA), Macquarie Bank, Suncorp Bank and Virgin Money currently ban all gambling transactions on their credit cards.

Big Four Blocks

And the big four? CommBank, NAB and Westpac recently introduced a system that allows cardholders to place a block on gambling transactions. With this block in place, cardholders can no longer use their credit card when they gamble – but, obviously there are restrictions to how effective this feature can be.

Let’s look at CommBank’s gambling and cash block as an example. To apply the block, you have to call the specialist team during office hours, Monday to Friday. CommBank will apply the block immediately, and will stop “cash advances and cash-equivalent transactions, including gambling transactions” from being processed over a specified period of time.

Blocked transactions should include:

-

- Most gambling transactions, such as TAB, online gambling sites and lottery tickets

- Other transactions CommBank considers to be cash equivalents, such as money transfers or travellers cheques

- Money withdrawn or transferred by the primary or additional cardholders at ATMs, online, or over the counter at any CommBank branch

However, CommBank notes that their online gambling block is for debit card customers only. That means, even with the block in place, credit card holders can use their cards to gamble online.

NAB offers a similar gambling and cash block feature, called a Gambling Restriction. NAB notes that by enabling this feature, cardholders will no longer be able to use their card for sports betting, casino games, lottery tickets, or online gambling. Cash advances and cash transfers from the cardholder’s credit card account are also blocked.

Gambling is permanently restricted on the bank’s ‘no-interest’ NAB StraightUp Card.

With its Gambling Preference feature, Westpac provides a similar offering. However, this feature only focuses on blocking gambling transactions, not cash advances.

And ANZ? ANZ doesn’t offer a blocking feature on gambling at all. Instead, it prevents gambling transactions from being processed when the cardholder reaches 85% of their approved credit limit.

Is It Enough?

While providing a blocking feature on their credit cards is certainly better than nothing at all, some may argue that the big four are not going far enough. People with gambling addictions often don’t realise they have a problem, which would make it unlikely they’d choose to self-impose a block on their gambling transactions.

In an interview with IAGR News, Director of Office of Responsible Gambling NSW, Natalie Wright said, “Responsible gambling means only gambling with what you can afford to lose. In our advice to the community we always advise against borrowing money to gamble, whether it’s through a credit card or loan, or by borrowing money from family or friends.”

On discussing Macquarie Bank’s ban on credit card use when gambling, Ms Wright said it’s just one part of the solution. “This will help to prevent people gambling with credit, but it’s important that there are a range of strategies that people can use suited to their individual circumstances”.

“There is potential for banks to do more in this space to complement the harm minimisation interventions of industry and of governments,” she continued. The Office of Responsible Gambling would like to see more banks taking advantage of the opportunities that exist within their operations to prevent and reduce gambling harm, and to offer assistance to those experiencing problems with gambling.

“This could be through transaction limits, gambling or cash transaction blocks, not allowing gambling transactions at all, or through the support and outreach that they provide to people experiencing financial hardship or requesting support in relation to gambling.” (5)

Gambling Transactions and You

If you use your credit card to make gambling transactions, it’s important you understand how it all works. First up fees. Most credit cards process gambling transactions as cash advances, which means they typically come with a fee. This will either be a flat dollar amount, or a percentage of the transaction, say 2% or 3%. This fee will be charged on each gambling transaction made on the card.

Next, interest. When it comes to interest, cash advances are processed slightly differently to purchases made on the card. With purchases – as long as you paid your closing balance by the due date the previous month – you will typically enjoy a certain number of days before you start paying interest on those transactions.

On the other hand, cash advances start accruing interest from the day they are made. Cash advances usually attract a higher interest rate than purchases as well, making that interest cost stack up even faster.

TIP. While it’s not recommended you borrow money to gamble – i.e. use a credit card – if you are going to use a credit card to cover gambling transactions, choosing a card with a super low cash advance rate could help to keep your costs down. There are cards on the market with cash advance rates as low as 8% p.a., which would be easier to manage than a card with a cash advance rate of 22%.

Get Help

If you, or someone you care about, have a problem with gambling, try reaching out for help. You can get immediate assistance by calling the National Gambling Helpline on 1800 858 858 for free, professional and confidential support 24 hours a day, 7 days a week.

1. https://www.abc.net.au/news/2020-10-13/australia-online-gambling-covid-19-sportsbet-ladbrokes-tabcorp/12758084

2. https://www.abc.net.au/news/2019-12-05/bet365-whistleblower-says-winners-given-delays/11768486?nw=0

3. https://www.abc.net.au/news/2020-10-13/australia-online-gambling-covid-19-sportsbet-ladbrokes-tabcorp/12758084

4. https://www.nature.com/articles/s41562-020-01045-w

5. https://www.iagr.org/industry-news/major-australian-bank-bans-credit-card-gambling/h5>

6. Photo source: Getty images

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.