Balance transfer offer: Pay 0% p.a. interest on a balance transfer for up to 24 months. A 1% fee applies.

Unlimited points: You can earn 1 Virgin Money Point for every $1 spent on eligible purchases. Earn 80,000 bonus Virgin Money Points (worth $400 in gift cards) when you spend $3,000 or more on eligible purchases in your first 3 months from card approval.

Platinum services: Use Visa’s Platinum Concierge Service as a 24/7 personal assistant. You’ll get other Visa benefits including presale access to entertainment and sporting events, retail discounts and more.

Extras: No fee for an additional cardholder and you can sync your card with Apple Pay, Google Pay and Samsung Pay.

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Virgin Money Credit Cards

Discontinued: Virgin Money Anytime Rewards Card – Balance Transfer Offer

Updated 1 October 2025

As of 01 October 2025, this card became unavailable for application. This information has been left for those who still have the card or were previously interested.

Power through debt with 0% p.a. on a balance transfer for up to 24 months (with a one-time 1% fee) and get platinum perks for a reasonable $149 annual fee.

Earn 80,000 bonus Virgin Money Points (worth $400 in gift cards) when you apply and be approved by 10 October 2025, and spend $3,000 or more on eligible purchases in your first 3 months from card approval. Use Visa benefits including 24/7 concierge service, discounts and early access to entertainment events.

Terms and conditions apply.

Purchase Rate (p.a)

19.99%

Balance Transfer (p.a)

0% for 24 months

1% balance transfer fee applies.

Reverts to 20.99% p.a.

Annual Fee (p.a)

$149

Pros and cons

- High interest rate on purchases

- No interest-free days while you have a balance transfer

Creditcard.com.au review

Editor Review

Discontinued: Virgin Money Anytime Rewards Card – Balance Transfer Offer

Overall Rating

A lot can change in 2 years (ask anyone who’s had kids), and being debt-free has got to be one of the greatest goals you can achieve. A balance transfer offer like this can help get you there if you use it right and look out for some of the fine print.

This card also has some fun platinum perks and earns points that you can spend on gift cards, cashback, transfer to Velocity Frequent Flyer points or even gift to a buddy if you forgot their birthday.

Looking for more points? Virgin has a Virgin Anytime Rewards credit card that earns bonus points and has a shorter balance transfer period. You can check out our review for more details.

What I love about the Virgin Money Anytime Rewards card

The highlight of this card is its long-term balance transfer feature, so I’ll unpack that before diving into the other benefits. It’s a great tool for catching a break from the ever-growing snowball of interest and focusing on your balance instead.

How the 0% p.a balance transfer works: You can transfer up to 80% of your available credit limit within the first 3 months of your application being approved. You’ll pay 0% p.a. interest for up to 24 months as long as you at least make the minimum monthly repayments.

Things to know:- A 1% fee is charged. The fee is debited from your account on the day or day after your balance transfer is processed by Virgin. More credit cards are charging fees now and 1% is low compared to others. For instance, on a $3000 transfer the fee would be $30.

- The credit limit range is between $6000 and $100,000. Your limit will be determined by Virgin Money.

- A 20.99% p.a. cash advance rate is charged after the 24 months is up. It’s a decent rate compared to other cards that can charge between 24% and 30% p.a., but one you’d rather avoid if you can.

- You can transfer balances from Visa, Mastercard and American Express credit cards, personal loans and other lines of credit (like some buy now, pay later services).

- You can’t transfer balances from financial institutions or stores outside of Australia.

Other features and benefits

The Virgin Money Anytime Rewards - Balance Transfer Offer card has thrown in a few other extras, including earning points on your spending. Earn 80,000 bonus Virgin Money Points (worth $400 in gift cards) when you spend $3,000 or more on eligible purchases in your first 3 months from card approval.

Earning points: You can earn 1 Virgin Money Point for every $1 spent on eligible transactions with no limit to the amount you can earn. Points are transferred to your Virgin Money Rewards account within 15 days of the eligible transaction.

Virgin Money says “Eligible Transaction means any purchase excluding (but not limited to) Cash Advances, Balance Transfers, Special Promotions, BPAY payments, refunds and chargebacks, purchases of foreign currency and travellers cheques, transactions made in operating a business, bank fees and charges such as interest and ATM charges, and government related transactions. Government related transactions include transactions with government or semi-government entities, or relating to services provided by or in connection with government (for example but not limited to transactions made at Australia Post, payments to the Australian Taxation Office, council rates, motor registries, tolls, parking stations and meters, fares on public transport, fines and court related costs).”

Visa platinum extras: The Visa Platinum Concierge Service is ready round-the-clock to organise bookings, appointments, gift ideas and deliveries. The Concierge can make recommendations and book custom trips with priority booking and discounts.

Other Visa benefits include Visa Offers + Perks, which gives you exclusive access to presale tickets to entertainment and sporting events, and discounts with partnering retailers.

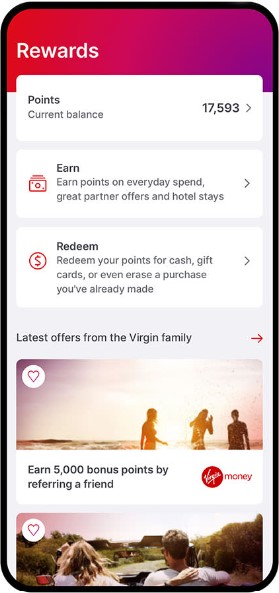

Redeeming Virgin Money Points

You can view, share and spend your points flexibly in the Virgin Money app. To give you an idea, you can use:

- Points for gift cards: buy digital gift cards from brands like Amazon, Bunnings, JB Hi-Fi and Woolworths.

- Points for cash: redeem a minimum of 500 points for cash that’s credited to your account (10,000 points is worth $46 cashback).

- Pay with points: nominate a recent purchase and use points to pay it off instantly.

- Transfer points to your travel program: use points to book trips with partnering travel groups or convert points to your Velocity Frequent Flyer membership.

- Reserve travel: book your next getaway instantly with partnering hotels.

- Share your points: you can transfer points to a friend with a Virgin Money Rewards membership.

What’s not so great

The balance transfer offer is the hero of this card, but you won’t get any interest-free days while you have one active. That means any purchases you make will be charged interest immediately.

If your goal is to pay off a balance, it might be wise to reach your goal before using the card for everyday purchases.

Who suits the Virgin Money Anytime Rewards card - Balance Transfer Offer

This is a “money tool” kind of credit card that can be helpful if you’re lugging around debt from other accounts and want to take action on it.

Virgin Money is one of only a few cards that allow transfers from personal loans and lines of credit, which could be a sigh of relief if you have debt outside other credit cards.

User reviews

Rates and fees

Interest rates

Purchase rate 19.99% p.a.

Cash advance rate 20.99% p.a.

Interest free period on purchases up to 55 days

Balance transfer

Balance transfer rate 0% p.a. for 24 months

Balance transfer revert rate 20.99% p.a.

Balance transfer from personal loan Yes

Balance transfer fee 1% one off

Balance transfer limit N/A

Brands you can't balance transfer from Bank of Queensland, Coles, IMB, NAB, Qantas Money, Suncorp, Virgin Money

Credit limits

Minimum credit limit $6000

Maximum credit limit $100,000

Fees & repayments

Annual fee $149 p.a.

Additional cardholder fee $0 p.a

Foreign transaction fee 3.3%

Minimum repayment $30 or 2%, whichever is greater

Cash advance fee 2.7% (amounts of $100 and over); $2.70 (less than $100); $5 (international)

Late payment fee $30

Rewards and points

Rewards program

Rewards Program

![]() Virgin Money Rewards

Virgin Money Rewards

Bonus points N/A

Annual points cap uncapped

Bonus points spend criteria N/A

Earning points with this card

Virgin Money Rewards points 1 point per $1 spent

Points cap per month N/A

Overseas earn rate same as standard earn rate

Additional features

Complimentary insurance

International Travel Insurance No

Flight Inconvenience Insurance No

Transit Accident Insurance No

Smartphone Screen Insurance No

Purchase Protection Insurance No

Extended Warranty Insurance No

Rental Vehicle Excess In Australia Insurance No

Overview

Discontinued: Virgin Money Anytime Rewards Card – Balance Transfer Offer

Power through debt with 0% p.a. on balance transfers for 24 months (with a 1% one-time fee). Earn points on your spending + pay a low annual fee.

Key features

- 0% p.a. on balance transfers for up to 24 months

- Earn 1 Virgin Money Point for every $1 spent on eligible purchasesAdd one free additional cardholder

- Up to 55 days interest-free on retail purchases

- Use Visa platinum privileges such as concierge services, discounts and presale tickets

- Add your card to Apple Pay, Google Pay and Samsung Pay

Minimum criteria to apply for this card

-

Be over 18 years old

-

Good Credit and have not applied for multiple credit cards recently

-

Resident or citizen of Australia

-

Minimum income of $35000 p.a.

You have your personal details ready to complete the online application

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Yoummi

19 July 2025Pauline

23 July 2025