Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Looking back over the past few weeks, it’s somewhat surprising to see how much our lives have changed in such a short space of time. No more eating out at restaurants, no more catching a movie at the cinema, no more after-work drinks with friends, no more working out at the gym. Where we can, we stay in to work and we stay in to play. We step out to shop for food, to exercise, and if necessary, to care for those in need. But, on the whole, we stay home, we self isolate, we stay safe.

For the most part, these changes will be temporary. Once the restrictions have been lifted, restaurants, cinemas, bars and gyms will be filled once more. We will go back to work, slogging it out on the long commute, dreaming of the days when we hung out in our pyjamas all day and got sick of Netflix asking us, somewhat judgmentally, if we were still watching.

However, there will also be things that don’t change, or at least, that will take time to return to a new normal. For example, we may not be quite so eager to travel overseas, especially on a cruise. We may also remain careful about what we touch when we’re out and about, suspicious of any potential for picking up germs. Which brings us neatly to the subject of money.

Over the past weeks, there has been a definite shift in way we pay, with merchants moving away from cash – and the germs it may carry – declaring their preference for card payments instead. And while Australia is not new to the idea of choosing cards over cash, as coronavirus continues to assert its influence over what we can and can’t do, Aussies are being encouraged to use contactless more than ever as a way to slow the spread.

Contactless Yes, Cash No

Back in March, there was a theory that the World Health Organisation (WHO) was advising people to use contactless payments instead of cash to reduce the risk of COVID-19 transmission, however, this theory has since been debunked. Indeed, the WHO was advising people to wash their hands after touching money, especially if handling or eating food, but it gave no official warning against using cash during this pandemic.

Needless to say though, with evidence of COVID-19 being found alive and still infectious on surfaces after periods of up to three days, it’s no surprise Aussies are now shunning cash, WHO directive or no WHO directive. Cash has long been considered ‘dirty’, and now, more than ever, people are thinking about where their money has been before it reached their pocket. Did someone with coronavirus sneeze on that note? Could you pass it on to Grandma if they did?

Shops, cafes and other retail outlets that remain open seem to be thinking along the same lines, moving to cashless payment methods to protect both their employees and their customers. And while the WHO may not be offering official advice on the subject, the Shop, Distributive and Allied Employees Association is. According to the association’s National Secretary, Gerard Dwyer, “cash is a carrier”.

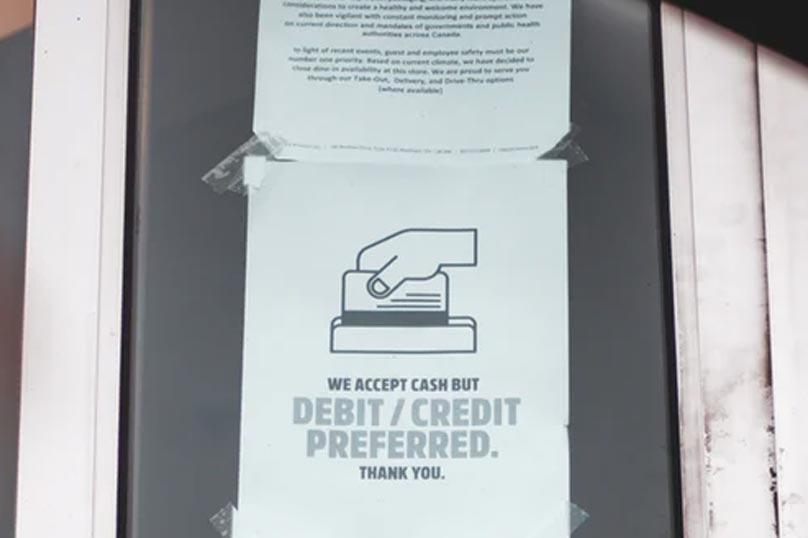

Which is why, when out and about, you may have noticed signs in stores advising you that either cash is no longer accepted, or that contactless payment is preferred. For those employees who do have to handle cash, many are now wearing gloves. According to a spokesperson for McDonald’s, the chain went one step further, training their employees how to give and take cash from customers in a way that minimised contact.

|

How clean is your card? According to a US-based study, credit cards carry more types of bacteria than coins or cash (1). So, while you may be choosing to use your cards rather than cash, it could be worthwhile giving your card a clean. You can then work on keeping it clean by avoiding touching the payment terminal with your card when you tap and go. |

And so, we leave our coins in our spare change jars, our notes in our wallets, and we use our cards to pay instead. But, whether we were ardent fans of contactless before coronavirus hit or not, it’s safe to say that every time we tap and go now, the habit becomes that little bit more ingrained. Which is why some experts are saying we may not go back to cash after all this is over, leading many to think that this will be the end of cash here in Australia.

Time To Wash Your Card?A recent study carried out by the University of Texas found that credit cards – among other commonly used payment devices such as payment tablets and ATM keypads – commonly carry bacteria that cause illnesses (2). Some of the nastiest bugs uncovered within the study included staphylococcus aureus (which causes staph infections), and salmonella enterica (a common source of food poisoning). So, should you be washing your credit card? Given the fact that there is now the potential to catch more than just a staph infection or gastro from your credit card, this could indeed be a good time to give both your cards and your wallet a bit a of clean. According to Dr Stephen Thomas, professor of medicine and chief of the infectious disease division at Upstate Medical University in Syracuse, New York, washing a credit card in warm, soapy water should work to wash away the COVID-19 virus.

It should be pointed out however, that vigorous cleaning may impact the card’s functionality, especially if the card’s chip or magnetic strip is damaged. So, if you plan on washing your cards, a scourer may not be your best choice of cleaning implements. |

Is It Legal?

Before we go any further, it’s worth touching on whether this idea of merchants not accepting cash is actually legal. For many Aussies, especially those of the older generation, cash is still king. They like having cash, they like using cash, and they don’t particularly like the idea of having to use anything but cash when cash is still ‘legal tender’.

It seems there is a widespread belief that because official Australian coins and banknotes are legal tender, merchants must accept them as payment. However, the law sees it somewhat differently. According to the Currency Act, merchants have certain rights when it comes to accepting payments. A merchant may limit the dollar amount in coins a customer may use to make a purchase, for example, to $5 worth of silver coins, or $20 worth of gold coins.

As for not accepting cash at all, again the law is on the merchant’s side. According to the Reserve Bank of Australia, merchants are “at liberty to set the commercial terms upon which payment will take place” before the purchase, “and refusal to accept payment in legal tender banknotes and coins is not unlawful”. So, as long as the merchant has a sign at the counter that lays out these terms, which is visible to customers before the point of purchase, it is within its rights not to accept cash.

Pushing For Contactless

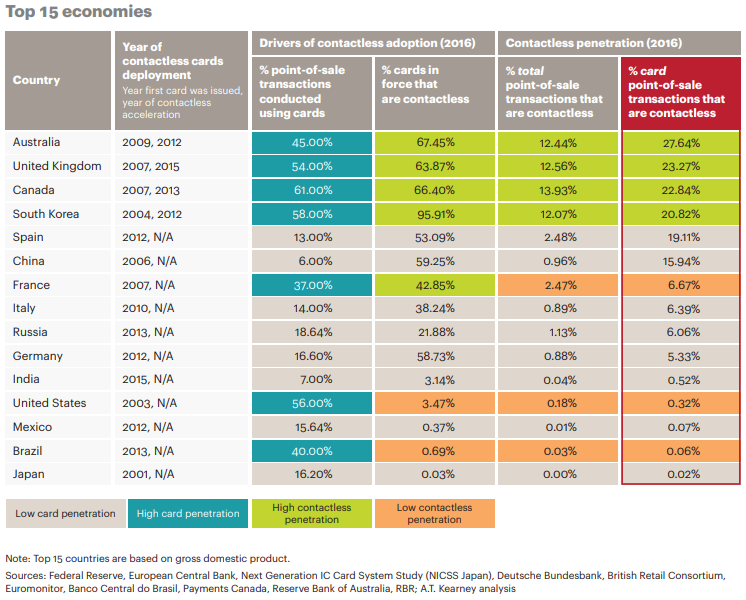

With merchants pushing for card payments over cash, contactless is becoming the way to pay, not just here, but in many other countries struggling to get a handle on the coronavirus crisis. For some of those countries though, the move to contactless may be problematic, especially if there is no established contactless network in place – or if cardholders have been hesitant to utilise the technology up to now.

That won’t be an issue here, however. While it may have taken a few years to catch on, contactless is now well established in Australia. So much so, we now have one of the highest contactless usage rates in the world. According to Mastercard, 85% of transactions under $100 made through its Aussie network are contactless, while Visa says contactless payments account for 92% of its in-person transactions (4).

So, we like to tap and go, it seems – and even more so now. “Tap and go has been used extensively over the years,” Russell Zimmerman, from the Australian Retailers’ Association, said in an interview with 9News. “It’s just we’re seeing a lot more of it at the moment, by a long way.” (5)

Which is great news as we all work on limiting our contact with others. After all, when we use our card to tap and pay, there is no need to have any physical contact with either the payment terminal or the employee operating it. But, with the PIN-free limit set at $100, this really only works for smaller purchases.

Which is why a new PIN-free contactless limit is now being introduced. From April 9, a PIN-free limit of $200 began rolling out across Australia, starting at Coles and Woolies. And while the increased limit will only be available on participating cards at participating retailers, it should work to reduce the need for cardholders to enter their PIN when paying, helping to slow the spread, while making it safer for merchants and customers alike.

According to the Australian Payments Network, the limit increase is only designed to be a temporary measure. However, as more people make the move to contactless – and continue to use it more frequently – it may be that they don’t bother going back to cash when this is all over and life returns to normal.

Economic experts seem to be predicting this shift towards plastic could indeed be permanent. Deloitte Australia’s Richard Miller agrees that while these may be temporary measures, they will more than likely have a lasting impact. “People will be forced to use cards,” he said. “They’ll just get into the habit and they won’t go back.” (6)

What About Security?When contactless payments were first introduced, there were some concerns about the safety of having a card that allowed PIN-free transactions. What was to stop someone from stealing the card and running up a huge bill? Putting these concerns to rest, card providers put in place a $100 limit on contactless transactions, essentially limiting the amount of damage a thief could do. So, what happens now that limit has been increased to $200? Well, first of all, card providers continue to use fraud monitoring systems that are designed to track potential fraud and shut it down. Secondly, both Visa and Mastercard offer a Zero Liability policy, which means cardholders who are unlucky enough to fall victim to fraud will not be liable for fraudulent transactions. However, now that contactless is being used more and more, some are calling for tighter safety measures to be introduced. Biometrics, for example, could help to increase the security offered on contactless payments. That, of course, will take time to develop and implement, so for now we need to rely on the security measures currently in place. In its statement, Visa assures us that it has us covered. “Australians can rest assured that contactless payments experience among the lowest fraud rates of any type of payment.” Not only that, but “fraud at the physical point of sale has remained at historically low levels in countries where contactless payments have been widely adopted”. (7) |

What’s Happening Overseas?

What about everywhere else then? Of course, it’s not just Australia that has experienced rising numbers of contactless payments during this pandemic. Everyone is trying to slow the spread. Along with social distancing and washing our hands, tapping to pay is one of the few things we can easily do to make a difference.

To facilitate this, many countries are working to make contactless payments more accessible, with more than a few choosing to raise their PIN-free limits. So, just like Australia, that habit of reaching for a card to pay rather than cash is set to become all the more ingrained.

New Zealand

Across the ditch, the New Zealand Payments Industry announced last week that its contactless payment limit would increase temporarily from NZ$80 to NZ$200 ($76 to $190). However, local bank ASB highlighted some technical issues the industry may have implementing the change, when it announced that its debit and credit cards would continue to have a $80 limit, as they were hard-coded to do so.

Turkey

Before coronavirus hit, Turkey was seemingly not a fan of contactless. However, some 2.5 million contactless cards were used for the first time in March in Turkey, creating a 170% increase in contactless payments year-on-year for the month. Data also showed the total amount of debit and credit card payments surged 9% to TL 85.5 billion ($19.6 billion) in March, while the number of cash withdrawals from ATM machines declined 14% compared with the same month in the previous year. (8)

Canada

With one of the world’s top contactless usages, Canada also chose to increase its PIN-free limit, to CAD $250 ($281). In a statement, Mastercard said, “Canada has been recognised as one of the most cashless societies in the world, and the majority of in-person Mastercard transactions in Canada are already tapped. With this change, this contactless adoption is expected to grow even further.” (9)

USA

While it may be close to Canada geographically, the USA’s use of contactless is worlds apart. Back in 2018, a study showed that an estimated 3% of cards in the US were contactless. The study highlighted the fact that cash was still incredibly popular, with consumers conducting almost 50 billion cash transactions a year, representing 26% of all consumer payment transactions. (10) Needless to say, contactless usage in the US has increased since then, with more contactless cards in operation, and payment terminals in use.

UK & Ireland

As another top contactless adopter, the UK similarly chose to increase the PIN-free limit from £30 ($59) to £45 ($89) in early April. Over in the Republic of Ireland, authorities raised their PIN-free limit from €30 ($52) to €50 ($86).

Belgium

In Belgium, the PIN-free limit for contactless payments was previously €25 ($43), but has now been raised to €50 ($86) per transaction. If successive contactless payments are made, the cumulative limit is now increased to €100 ($172).

Middle East and Africa

According to Mastercard, it is “championing efforts to facilitate contactless payment limits across the Middle East and Africa region”. Its data shows that in 2019, the MEA region experienced more than 200% growth in contactless transactions, so that today almost 1 in 9 Mastercard transactions at POS terminals in MEA are contactless. (11)

Contactless To Cashlessness

So then, what’s the story with contactless payments in Australia? Why is it that Aussies chose to adopt this technology so readily when so many other nationalities continued to shun it? Well, when it comes to technology, Australians have long been known as early adopters. For one reason or another, we just love a bit of tech.

|

Time for some stats. According to the latest Reserve Bank Consumer Payments Survey (12), cash now makes up only 10% of the value of consumer payments in a typical week, down from 20% in 2013. Instead, the majority of payments are made up of debit card payments (44%, up from 24% in 2013) and credit and charge card payments (19%, with no change from 2013). What’s perhaps most surprising however, is the fact that, according to the survey, one third of Australian consumers are not using cash at all. While low income earners and those in the over-65 age bracket continue to rely on cash, younger Aussies are leading the charge towards cashlessness, with respondents aged 40 and under saying they used cash for less than 15% of their transactions last year. |

“This ongoing shift to cards for relatively small purchases has been facilitated by the adoption of contactless functionality by consumers and merchants. Around half of all in-person payments were made by tapping a debit or credit card on a card terminal in 2019,” the RBA said. Overall though, the survey showed that 83% of point of sale card transactions were contactless.

And, of course, it’s not just the RBA that’s got something to say on the matter. Last year, global firm Research and Markets predicted that Australia could become the Asia-Pacific’s “first cashless society” by 2022. Meanwhile, the Commonwealth Bank offered a more restrained forecast, saying that was likelier to happen by 2026.

What other factors may push us into cashlessness then? Online shopping, for one. As we spend more time at home – some of us with a lot of time on our hands – the desire to hit the shops online will become even more pressing. Forming a habit that may persist out of isolation, we may continue to shop online for everything from toilet paper (got to love that subscription service) to crafts for the kids (got to keep them busy), thereby pushing card payments more, and decreasing potential cash payments made in-store.

Another factor that will likely encourage a move away from cash is the rise of digital wallets. While the RBS survey showed that use of contactless payments via smartphone was still pretty low here in Australia (5% of in-person payments were made using a smartphone or other payment-enabled device), it was on the rise.

What Would Prevent Us From Going Cashless?

Okay then, if we are heading ever-forwards to a cashless future, what factors could potentially prevent us from getting there?

For the most part, hoarders. According to a paper published last year (13), it’s estimated that around half to three-quarters of Australia’s banknotes are currently being ‘hoarded’, both here and overseas. The people hoarding this cash may not trust banks, or perhaps, may not want the banks – and therefore, the government – to know they have it.

And the rest? The paper estimated about 15-35% of Australia’s cash was being used for ‘legitimate reasons’, while the rest was either lost or being used in the black economy.

Apart from that though, there are several good reasons why Australia shouldn’t kill off cash completely, or at least not yet.

According to the RBA survey mentioned earlier, there are two groups that still rely heavily on cash day-to-day: low income earners and those aged 65 and over. When it comes to seniors, the potential for digital exclusion could play a big part in us not going cashless. Many older Australians may not feel comfortable using a debit card, never mind a banking app.

Over in the UK, the banking trade body, UK Finance, predicts the country will become “virtually cashless” within the next decade. However, Natalie Ceeney, independent chair at the Access to Cash Review, is concerned about those who continue to depend heavily on cash.

“People who are most dependent on cash are generally the most vulnerable members of society,” Ms Ceeney said in a Financial Times interview. “We’re talking about people who are older, who are poorer, people who have disabilities, or live in rural areas.”

In terms of coronavirus killing cash, she said, “I’m not merely worried about the lockdown, I’m concerned about what happens after. There is a severe risk that people will still need cash, but the infrastructure will no longer be there.” (14)

However, it’s not just those who are considered high-risk who may have something to say about Australia going cashless. Some like the security cash offers, while others complain that they spend more when cash isn’t involved in the transaction. For those who like to fly under the radar, going cashless would make that virtually impossible.

Is Cashlessness A Possibility?

Weighing up the pros and cons, the government may decide to overlook those factors, especially if it helps its bottom line. The cost of producing, distributing and protecting physical currency is enormous. Over in the US in 2018, the cost alone of printing new banknotes was almost US$900 million ($1.4 billion).

And the cost of keeping cash in use extends further than the government – banks and merchants are also paying a hefty price. A recent Morgan Stanley study showed that the Bank of America spends US$5 billion ($7.9 billion) each year processing cheques and cash.

As for merchants, think about how much longer it takes to hand over cash and get your change at the checkout compared to using tap and go. One study by research firm IHL Group found that if you take into account the time it takes to make change, count notes and coins at the end of the day, and take the money to the bank, the cost of accepting cash would total between 5% and 15% of a merchant’s sales. (15)

So, is it possible? Could Australia go cashless? Well, there’s no doubt this push towards contactless payments as a result of coronavirus will go a long way towards leaving cash behind, but it’s unlikely we will go cashless any time soon.

If you look to Sweden – a country at the forefront of the cashless movement – it has worked incredibly hard over the past decade to eliminate cash, but despite those efforts, 15% of its financial transactions still involve physical money. But, it is on the right track.

Its public transport system and many of the country’s stores no longer accept cash. Person-to-person payments are typically digital, made using a mobile app called Swish. Swedish seniors also seem to be on board, with at least half of Sweden’s over 60s using Swish. Going one step further, thousands of Swedes have had microchips implanted in their skin, allowing them to make payments with a wave of their hand.

|

While that may sound a bit sci-fi, even to us early adopting Aussies, this type of technology could make it to our shores sooner than you might think. In the meantime though, let’s concentrate on staying safe through this pandemic. You may not have a microchip implanted in your arm, but you can still use your card to pay, keeping germs at bay using contactless technology. Cashlessness will come in time, you’ll see. |

Sources

1. https://www.creditcards.com/credit-card-news/credit-card-germ-study.php

2. https://www.creditcards.com/credit-card-news/credit-card-germ-study.php

3. https://www.creditcards.com/credit-card-news/credit-card-germ-study.php

4. https://www.zdnet.com/article/mastercard-ups-contactless-payment-limit-to-au200/

5. https://www.9news.com.au/national/coronavirus-australia-tap-and-go-payments-encouraged-to-stop-shoppers-spreading-covid-19/7145149b-3550-4fac-b026-25d7e32a6e20

6. https://www.9news.com.au/national/coronavirus-australia-tap-and-go-payments-encouraged-to-stop-shoppers-spreading-covid-19/7145149b-3550-4fac-b026-25d7e32a6e20

7. https://www.visa.com.au/about-visa/newsroom/press-releases/visa-applauds-the-move-to-temporarily-raising-the-contactless-payments-limit-in-australia.html

8. https://www.dailysabah.com/business/economy/coronavirus-changes-buying-habits-drives-up-contactless-payments

9. https://newsroom.mastercard.com/press-releases/mastercard-enables-higher-contactless-payments-across-canada/?utm_source=miragenews&utm_medium=miragenews&utm_campaign=news

10. https://info.kearney.com/24/2185/uploads/why-us-banks-should-make-contactless-cards-an-immediate-priority.pdf?intIaContactId=8590813391&intExternalSystemId=1&strExternalSystemType=Interaction+5.6

11. https://thepaypers.com/online-payments/mastercard-works-towards-facilitating-contactless-payment-limits-in-middle-east-and-africa–1241623#

12. https://www.bankingday.com/nl06_news_selected.php?selkey=25982&stream=50

13. https://www.abc.net.au/news/2020-03-20/will-coronavirus-kill-off-cash-in-australia/12065860

14. https://www.ft.com/content/1282a37a-37ec-4667-adc4-4c1092b3db48

15. https://www.townandcountrymag.com/society/money-and-power/a25682980/end-of-cash/

16. Photo source: Pexels

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.