Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Making your credit card repayments ahead of time just became even more important. Even though nobody may notice today if you’re 3 days late paying your monthly credit card bill or your quarterly electricity statement, soon any potential lender will be able to see every time you’ve missed one payment or been a few days late. They can use what information they find to help them decide whether or not to lend to you or give you a credit limit increase, or a new credit card, so while it may not mean the end of the world, we think you’d agree it’s better to be safe than sorry and get your finances in order today (see the list at the bottom of this article for more on how to do that).

What do lenders see on my credit file? Will it change?

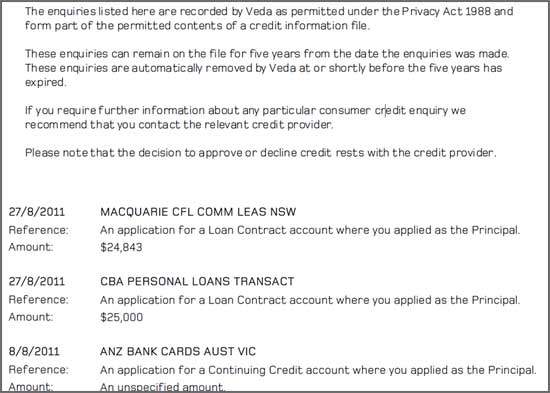

So, how will a lender be able to see if you’ve missed even one payment, or been a few days late? There are changes to the Privacy Act on the way which will mean that every time you apply for a credit card, personal loan or home loan a lender will have access to much more information than what they can see today on your credit history. As of now, they are only able to see how many previous credit enquiries you’ve had over the past 5-7 years, and any registered defaults, and of course whether you have been declared bankrupt. Next year they will be able to see the repayment history for every credit contract that is listed for the previous 24 months (2 years).

The changes will go back to the beginning of 2012 when they take effect in March 2014, so the last year or so of your repayments from now will also be visible. What we have now in Australia is known as a ‘negative’ reporting environment, meaning that only defaults or serious issues are recorded on a person’s file, but when the laws change and lenders can share repayment data with each other, we will be in what’s known as a positive reporting environment – where good behaviour will also count. This is really only bringing Australia into line with many other countries in the world when it comes to credit reporting, including the United States.

In the new ‘positive’ environment lenders will be able to consider the following information, according to a spokesperson from one of the major credit reporting agencies, Veda:

- How many credit accounts you hold, and what type they are (credit card, car loan, home loan etc)

- The limit on each account. Currently the bureau sees how much you applied for but not always how much you were approved for

- 24 months of your repayment history – were they on time?

- Whether you managed any old credit cards or loans responsibly

What effect do defaults currently have on a person’s credit file?

At the moment, only defaults (payments that are more than 60 days late and have been chased) of $100 or more are even recorded on a person’s credit file so tiny payments that are missed will not be flagged, but that will be changing too under the new rules. Defaults of $150 or more will be recorded as of March 2014. The lender will also easily be able to tell how seriously you treated your obligation to make repayments.

-a Veda spokesperson

The two biggest red flags on a person’s credit file will be a history of defaults, even small ones, and multiple credit enquiries (new applications for credit) within a short space of time. Both of these will signal the potential for future defaults to the lender, according to the Veda spokesperson. An increase in your income may not get you out of trouble either, because defaults carry so much weight with lenders. “Past defaults are very predictive of future defaults irrespective of income. In fact there is no correlation between income and probability of defaulting,” adds the spokesperson.

Will all credit providers have access to the same information?

All mainstream Australian lenders see the same information on your credit file now and this will continue in the future when the changes come into effect. For credit involving smaller amounts (less than a few thousand dollars), the process can also be automatic, where a computer logs in to the credit reporting agency database and checks that the information given on the application matches the information on record with the agency. The assessment is made on an automatic scoring system, which you, the applicant, pass or fail.

For larger amounts, such as car loans, home loans or high credit limits on a credit card, a person still has to intervene and consider other factors which aren’t noted on your credit report, such as your income, the value of secured assets you hold and your share of the household living expenses. This process is much more subjective, and it is determined by the banks or lenders individually.

Example of a credit history report

Who wins and who loses after the changes?

Heidi Armstrong of Statecustodians.com.au

The changes mean that different types of lenders may be interested in borrowers that they might not have approved previously, and that should be a good thing, for you as a borrower and for alternative lenders, such as non-bank home loan lender State Custodians. State Custodians caters to self-employed people as well as traditional borrowers, and offers products that may work for people who might not meet current strict criteria the banks have in place for lending. “Self-employed people can find it difficult to meet the criteria of a lot of lenders. There are also those that have experienced certain life events like a failed business, divorce or illness, that could affect a person’s credit history, but it does not mean they are unsuitable for a home loan,” notes State Custodians chief executive Heidi Armstrong.

The new rules will also help lenders like State Custodians make better assessments of a customer’s application, and continue to offer discounts to customers who have a very good credit history. State Custodians already offers loyalty discounts to customers who qualify after 5 years, and other lenders might feel confident to make similar moves. “With lenders and credit providers able to access a more detailed view of applicants and their capacity to make repayments, the information required to segment the credit market will become available,” says Steve Brown, Director of Consumer Credit with credit reporting agency Dun & Bradstreet.

-Heidi Armstrong, State Custodians chief executive

Those who have chosen to get themselves ahead on their home loan and take advantage of rate cuts to boost repayments may see better deals in some areas. Even if you’re not a home owner though, the changes should mean that if you have been monitoring your credit file and making repayments ahead of time or making additional repayments you will be further rewarded. “At a more refined level, we could see new categories such as ‘super premium’ applicants, whose detailed repayment history reveals that they are highly creditworthy individuals,” adds Brown. It isn’t hard to see that lenders will be happy to compete for good credit customers, and they will be easier to identify in the new credit reporting environment with so much more detail available on individual credit files.

Those who don’t own their own home, or who might have a default on their credit history will also be better placed to show lenders that they can make timely repayments and manage their finances with the detailed information available. Lenders can easily see how much the good outweighs the bad on your credit file in a positive reporting environment, so the news should be positive for most borrowers.

Will automatic credit approval be a good thing or a bad thing?

The new credit reporting environment is coming at the same time as a wave of new technology that makes credit assessment more automatic, seamless and remote. There are already plans under way at major banks to roll out a computer based bank account service where the account is approved set up and activated without a human doing anything. Forward thinking lenders are also already developing smartphone apps that will mean your loan can be approved within minutes while you’re sitting down enjoying your morning coffee or on the train to work.

-Steve Brown, Dun & Bradstreet

The new technology will mean much less human intervention, and zero human error, but also zero chance of bias in the decision-making process. Online lenders in particular will notice a difference (though almost all lenders these days have an online component). “The availability of comprehensive consumer credit data from next year onwards will mean that automated decisioning tools will be more capable of handling the potential risks in an online lending environment,” notes Brown. “Smarter automated scoring, coupled with comprehensive credit data, will mean less need for manual – and by their nature, subjective – lending processes.” This will lead to more ethical decision making in the end, for all types of borrowers, according to Brown. “This combination of technology and more detailed applicant data suggests we will see greater and fairer financial inclusion in the years to come.

5 things you should be doing now to protect your credit history

1. Automate your repayments if you haven’t already

Set up direct debits online so you never have to think about when a bill is due again. For the ones you can’t, set a calendar reminder to yourself and act on it immediately.

2. Pay off as much as you can – reduce your debt to credit ratio

If you’ve been paying the minimum off your credit cards and loan debt, start trying to pay at least double that amount until the balance comes down. It’s a good idea to try to maintain a debt to credit ratio of around 30% or less (how much you are allowed to borrow vs how much you actually owe)

3. Sort out any old accounts

clear up any defaults. Look at your credit file and cancel any accounts you no longer need or use. If you aren’t putting any money in them or using them they won’t be of any real use to you or your credit report.

4. Get a copy of your credit report and analyse it

You are entitled to one free copy of your credit report per year, so take advantage of it. Get your free credit report; look for any errors in your identifying information or any entries that don’t look right. If you see a debt you don’t recognise, or a lender you don’t know then contact the company and find out whether it’s really meant to be on your credit file. Errors are discovered every day, and sometimes these can be costly so make sure it doesn’t happen to you.

5. If you’re self-employed, always keep your two previous tax returns to verify your income

Heidi Armstrong of State Custodians, adds: “Keep in contact with your accountant to ensure all of your paperwork is in order and important documents (such as your tax return) are not overdue… the easier you fit into a mainstream loan, the lower your interest rate will be.”

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 9 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

American Express

Amex Membership Rewards: Changes Coming for Australian Cardholders

Tips & Guides

Can You Buy A Car With A Credit Card in Australia?

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

Ask a question

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

Siv

19 April 2021Roland

20 April 2021